Business Tax- R&D Tax credit and Loss usage is restricted. Why £20,000 restriction?

Article ID

business-tax-rd-tax-credit-and-loss-usage-is-restricted

Article Name

Business Tax- R&D Tax credit and Loss usage is restricted. Why £20,000 restriction?

Created Date

23rd September 2022

Product

Problem

IRIS Business Tax- R&D Tax credit and Loss carry back is being restricted- why? Why is there a £20,000 tax credit restriction?

Resolution

If you have a R&D credit claim and you also have a loss to be used against gains but you cant use it.

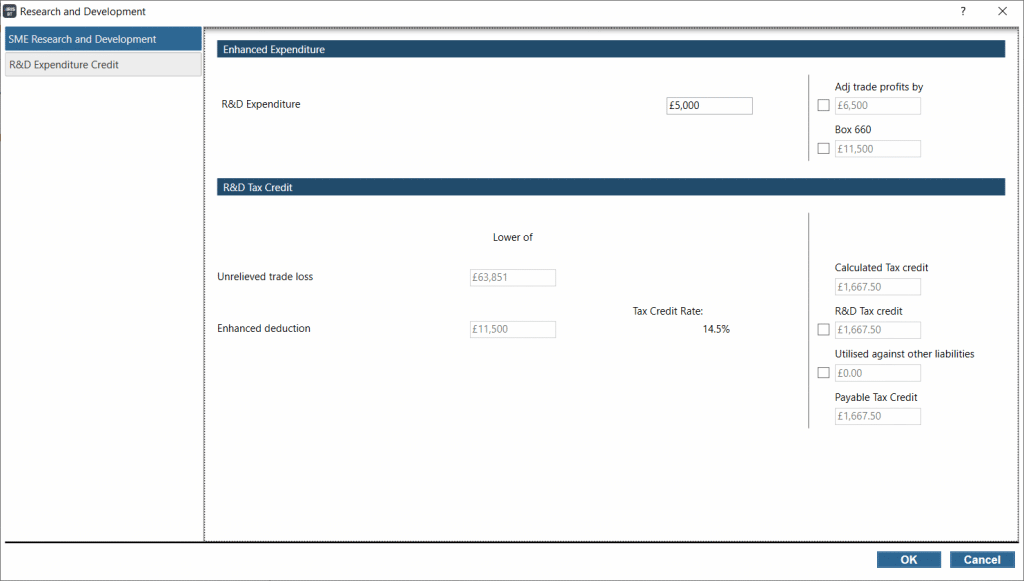

Go to Research and Development – SME R&D: Box 660 on the top right is automatically completed and it restricts the loss to be used (It will show in Edit/Losses/Less Adjustment to Tax credits will appear)

If you want to test: On the R&D screen – Reduce the R&D expenditure OR override 660 and change to lower amount or a 0 (this changes the Credit claim). Now Edit/Losses/ you can change the loss carry back to the higher amount BUT you cannot then claim the full credit claim.

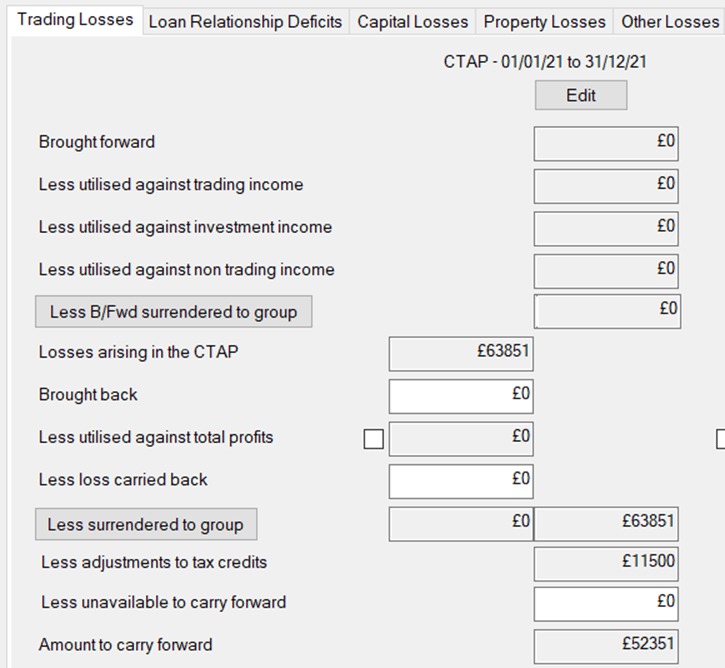

For example: £11500 shows on box 660

Edit and Losses: This £11500 will then show on ‘Less Adjustment to Tax credits’ – this restricts the loss and you cannot claim the full loss amount of £63851 – you can only use £52351.

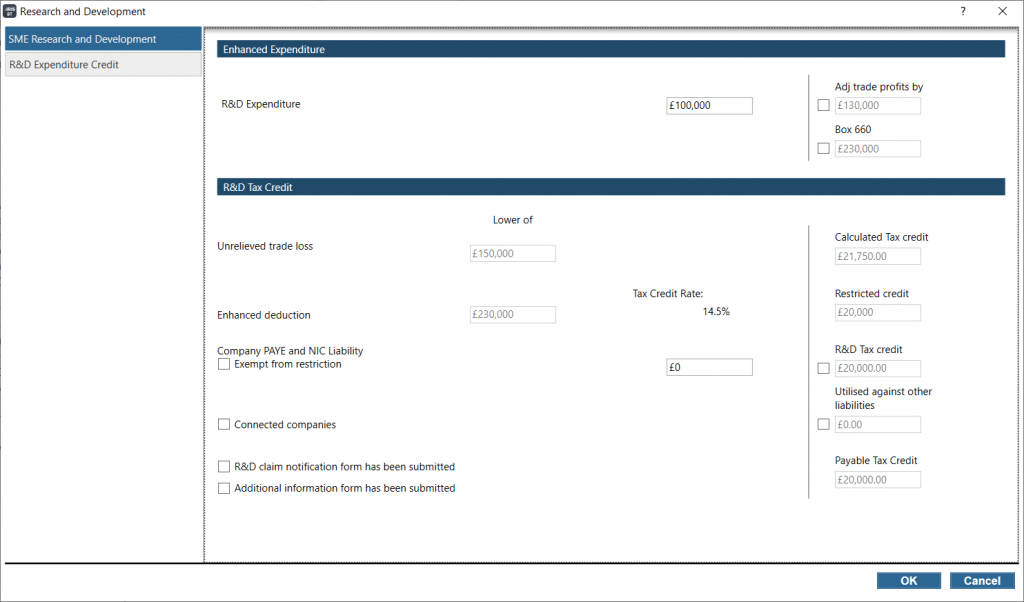

Why a R&D tax credit relief restriction to £20,000 – need to claim full amount

HMRC rules are being applied where your relief is auto restricted to £20,000 unless you have PAYE and NI liabilities. Enter these in the PAYE/NI box to increase the relief amount. OR tick exemption OR tick override for the credit and manually enter the relief amount. If you do tick the 2 options we recommend you add a note to the Tax comp explaining why.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.