Business Tax- Selection of Client has been aborted

Article ID

business-tax-selection-of-client-has-been-aborted

Article Name

Business Tax- Selection of Client has been aborted

Created Date

21st November 2022

Product

Problem

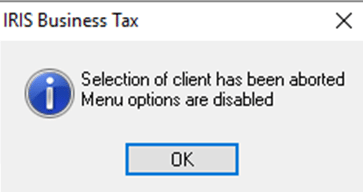

IRIS Business Tax- Selection of Client has been aborted , Menu options are disabled

Resolution

When you load a specific client in BT you get the warning

1.Make sure your IRIS version is up to date (Help and about/ Check for Downloads)

2. Close BT and restart it, load a different client and then load the affected client- if the warning appears ‘No Postings and Add posting’, say yes and fill this in. Check if the warning doesn’t show.

3. If the warning still appears then check these three steps:

a. If the client is a Non resident (SA700): Client and View – Untick ‘UK resident’. Close the screen and when you are back on BT – There is a option for ‘Liable for corp tax’ on the top right – tick this and it becomes a normal CT600.

b. If it has Multiple trades setup: Edit/Multiple Trades/Tax business allocation. You need to allocate the income and expenses for the other trade. So the warning will go away.

c. Date checks: Client, View, Periods and note down the periods you have created. Then exit this and at the top of BT – select the periods – it will list all the period postings made and then check dates are correct, if they are then go to Client and View and check the Incorporated and Commence date, if there is a incorrect entry then delete it and save. Close and restart BT

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.