Business Tax- CT600L and why box 530 R&D tax credit etc not filled in?

Article ID

business-tax-why-box-530-rd-credit-etc-is-not-filled-in

Article Name

Business Tax- CT600L and why box 530 R&D tax credit etc not filled in?

Created Date

10th September 2021

Product

Problem

IRIS Business Tax - Why is box 530 for R&D credit etc not filled in? CT600L page missing

Resolution

With the launch of the new HMRC form CT600L in 2021, the way that we calculate box 530 has now changed. The HMRC have advised that they have updated their guidance to reflect this. Please click on the link below for more guidance: –

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/968861/CT600_Version_3_guide_21_final_April.pdf

Under the new guidance we are correctly not populating box 530 as the value in 530 must be equal to the value L210 from the CT600L supplement. The credit will now show on the CT600L form.

If box 530 is being populated BUT you have no entries in SME and RDEC – Go to Data entry-summary-click NO for loan to participators on the right side. Then go to Data entry-overpayment and repayment claims and repayment claims tab and untick box 905. Re-generate the return and 530 will be empty.

CT600L page will not appear: If the company is not loss making/or no credit is being calculated and you enter the R&D Expenditure value for SME, then it will not create the CT600L pages. You can test this be either increasing the R&D value or changing it from profit to a loss making company and then see the CT600L page appear.

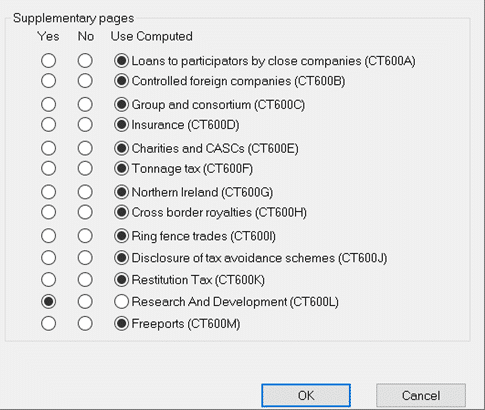

How to force the CT600L page: Data entry – summary – tick the YES to CT600L page. However the CT600L as per HMRC’s requirement is not required if not claiming a tax credit under SME rules or R&D Expenditure Credit. This is why no values can seen on the CT600L even when it is forced (for example L30 will be blank). If you want to show the details to HMRC then save the R&D values onto a PDF and attach it manually when generating a CT600.

CT600L page will not show on the Generated Tax return– As per HMRC’s requirement the CT600L is not required if not claiming a tax credit under SME rules or R&D Expenditure Credit EVEN if you tick YES on the Summary screen for the CT600L. It will only show for your own records when you run a Draft and Final return (and will show blank values if no Credit is given).

If you don’t want the CT600L page to show – tick NO.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.