Business Tax/AP/FAR- Currency Conversion tool? eg change or convert foreign to £ GBP

Article ID

ias-10736

Article Name

Business Tax/AP/FAR- Currency Conversion tool? eg change or convert foreign to £ GBP

Created Date

15th October 2012

Product

IRIS Business Tax

Problem

IRIS Business Tax/Accounts Production/Fixed Asset Register- Currency conversion tool? eg change foreign to £

Resolution

The AP and BT change currency/conversion rate system are linked together. The FAR has its own currency conversion tool. Follow the guide below:

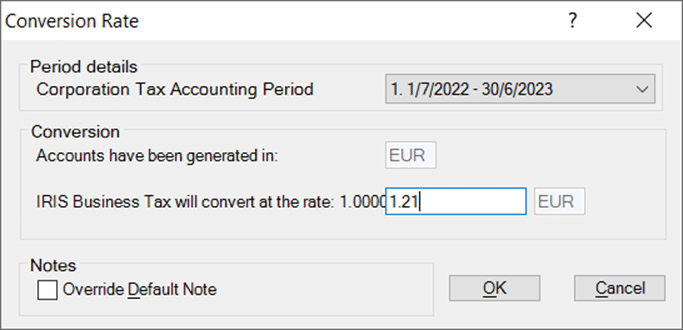

IRIS Business Currency Conversion tool – Load the company in BT, Edit and ‘Conversion Rate’. This can only operate (ungreys out) if the data originating from AP has already been changed from £ currency into US Dollar ($), The Euro (€), Yens (¥), Swiss Franc (Fr). However if the values are manually entered into BT (not from AP) is based on another currency, then you must manually change it to £ as the conversion tool only works on values from AP.

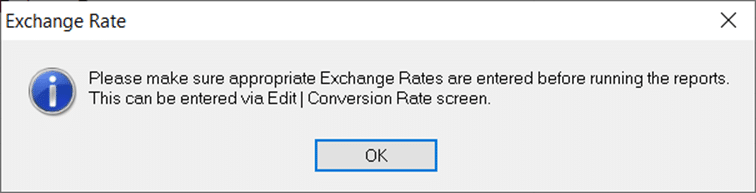

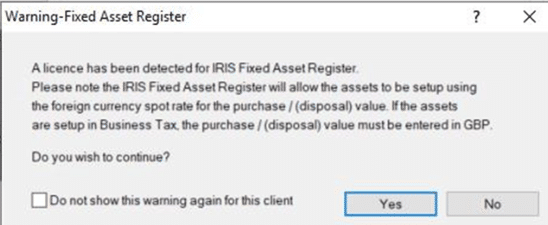

Conversion Rate option is greyed out? The rate is still set as ‘£’ in AP (so there’s nothing to convert) for the affected specific period and it must be changed – read the AP steps further below on how to edit currency. If you change the currency in AP first then reload the client in BT next, this Exchange rate warning will appear and asks you to enter the relevant rate for the currency.

What exact rate would I enter? You will need to contact HMRC Support on what rate to use based on the period.

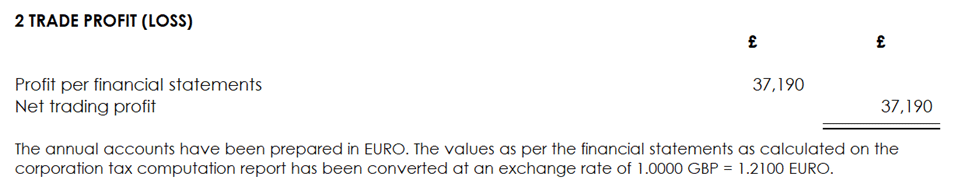

When you run the BT TRADE comp and under the Trade Profit(Loss) line there will be a line added explaining the exchange and the values will show the updated values based on your entered rate (the image above is just an example as it may be period based). If the note needs a edit, go back to the conversion screen and ‘Override default Note’.

NOTE: If you make manual changes to a Partnership business and the updated £ values do not show and the old foreign figures are still being pulled through as per AP. in BT go to Trades/Partnership/Overwrite or leave alone/Set it to ‘No leave alone’. Now make changes in BT.

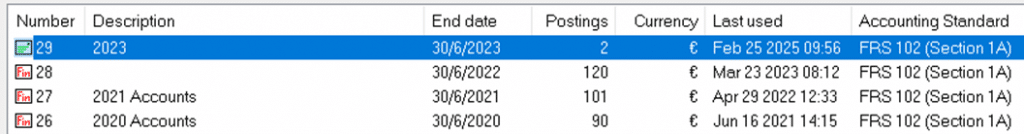

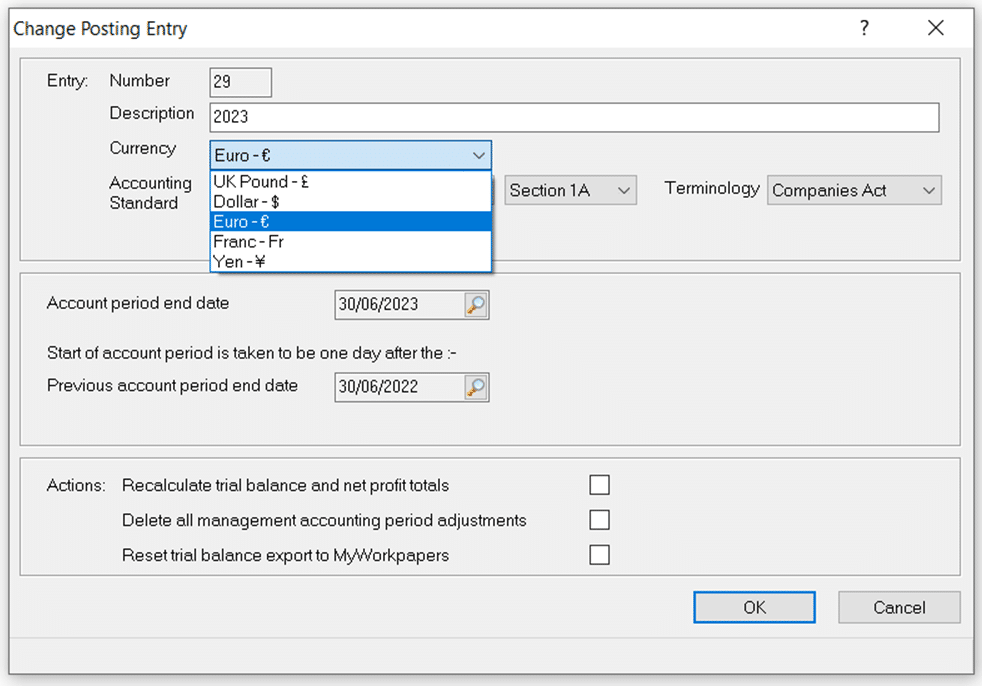

Accounts Production change currency (not conversion) – Load the company in AP, Posting, Post file maintenance – a list of clients will show, click on your clients company, click ‘Entries‘ – and a list of periods will show, select the relevant period and click ‘Change’, then manually change currency in the ‘Currency box’, this change is not set to every period so you need to select each period manually (there is no ‘apply to all periods’ tool). This is not a conversion tool, this only changes the currency type and not the values so if its entered as £1 and you change to Euro, then it will still show as 1 Euro in AP, its only when you transfer the AP values to BT is when the conversion tool is applied.

Fixed Asset Register Currency Conversion tool– When you register a client in FAR you may get this warning below, it is a warning for assets in FAR entered with a Foreign currency, you may need to use the currency converter in FAR to update the assets values so it can be used in BT Corporation tax as it only allows £ values. The FAR has its own conversion tool and is not linked/part of the BT conversion tool.

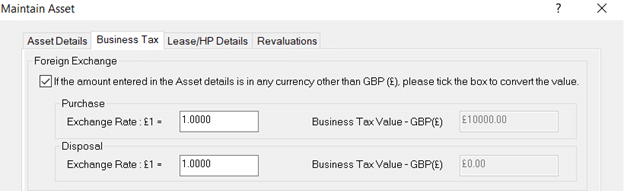

How to convert currency in FAR- Load the company in FAR, Edit, Asset Browser, locate the specific asset which has a non £ currency value and click on it, Click ‘Details’, Go to the ‘Business Tax TAB’. Click the ‘Foreign exchange’ option and enter the relevant currency rates in the PURCHASE/ DISPOSAL boxes and OK. This has to be done per asset (there is no ‘apply to all assets’ tool). Run the FAR ‘Asset Details’ report which shows the ‘Original purchase’ and its conversion to ‘BT purchase’ etc. If you need to view this conversion in BT, load the company in BT, Capital allowances, A-maintain assets, it will show the converted £ currency value for Purchase/Disposal based on the rate you applied in FAR.

To remove the conversion: Change the two values to 1.0000 and it allows you to untick the Foreign Exchange tick box, it will again use the original values entered into FAR for BT.

What exact rate would I enter? You will need to contact HMRC Support on what rate to use based on the dates/period.

Recommendation: As the conversion is applied PER asset (and if you have a lot of assets) you may want to keep a note which asset has this conversion applied etc so you can keep track.

Original release IRIS version 2011/2012. On Version 11, Clients can now prepare Accounts in Yen/Swiss Francs in addition to Pounds/Dollars/Euros and convert these automatically into Business Tax. The following currencies are as follows: UK Pound (£), US Dollar ($), The Euro (€), Yens (¥), Swiss Franc (Fr). To enter the conversion rate in Business Tax, please select Business Tax | Edit | Conversion Rate (Note: this tool no longer operates in later IRIS versions and is greyed out). These are the only currencies that can be produced in Accounts and therefore converted in Business Tax.

To access this screen from the Accounts Production module, Select: Accounts Production | Posting | Post File Maintenance | Entries. Accounts Production will display a list of existing post files for the business, highlight the post file you wish to change and select Change.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.