Business Tax- Invalid Data Entry: Name, Data or Status (Capital Allowances)

Article ID

ias-12871

Article Name

Business Tax- Invalid Data Entry: Name, Data or Status (Capital Allowances)

Created Date

13th August 2018

Product

IRIS Business Tax

Problem

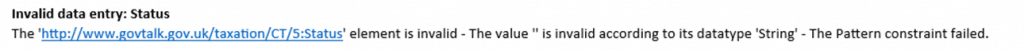

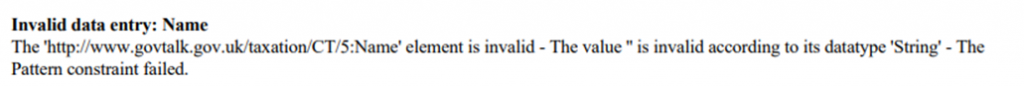

IRIS Business Tax: Validation: Invalid data entry : NameThe 'https://www.govtalk.gov.uk/taxation/CT/5:Name OR Status' element is invalid - The value " is invalid according to its datatype 'String' - The Pattern constraint failed. Invalid data entry : StatusThe 'https://www.govtalk.gov.uk/taxation/CT/5:Status' element is invalid - The value " is invalid according to its datatype 'String' - The Pattern constraint failed.

Resolution

The validation could be similar to this below, either name, data or status:

If you receive the message above please do the following steps within Business Tax:

1.Load the Company and relevant period

2. Data Entry, Group and Consortium, Enter an Full name at the bottom and choose a Status at the bottom of the screen

3. Data Entry, Declaration – Enter the date, name and Status

4. Data Entry, Overpayments and repayment claims – bank details and payments to person – enter the account name (if its missing)

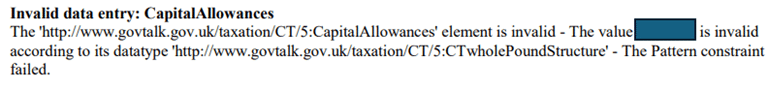

5. If the validation shows: ‘Capital Allowances’ check all the entries for the quoted value/text and edit it (eg use whole pounds) and it can be linked to the surrendered losses given or taken between the companies so check there as well.

6. If the validation shows ‘Allcharitable’: https://www.iris.co.uk/support/knowledgebase/kb/business-tax-invalid-data-entry-allcharitable/

For the full list of Invalid warnings – Read this KB

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.