Configuring a Charity in Accounts Production

Article ID

kas-0026

Article Name

Configuring a Charity in Accounts Production

Created Date

6th January 2021

Product

IRIS Keytime, IRIS Keytime Accounts Production

Problem

Configuring a Charity in Accounts Production

Resolution

Before you can begin posting transactions, you need to configure certain options within the charity record. The client record in Practice Manager will set the type of charity (incorporated, unincorporated or charitable trust) and the country where the charity is registered (England & Wales, Scotland or cross border), beyond initial setup these settings are found in Maintain / Client.

Independent Examination or Audit

On setup the charity will default to independent examination, beyond initial setup you can change this in Maintain / Client. If the charity is incorporated and an audit is required there is a further option to specify whether the audit is under the Companies Act or the Charities Act.

Click Save, you will be presented with options to:

- Create funds

- Define charitable activities

- Define support costs

We will look at each of these areas in the sections below.

Funds

You can create as many funds as required, these are defined as either unrestricted (general or designated), restricted or endowment (permanent or expendable), the software creates a General fund by default and this cannot be removed. The SoFA (Statement of Financial Activities) reports by fund type, the balance sheet reports current and previous year columns with a further breakdown of assets and liabilities by fund supplied in the notes to the accounts.

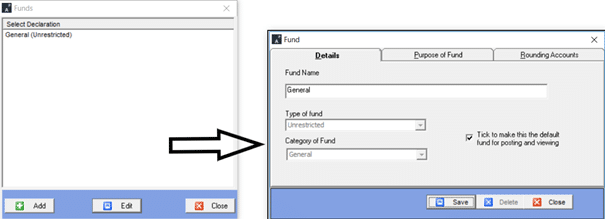

To create a fund:

On setting up a new company you will be prompted to create funds, to create a fund once the initial setup has been completed click the Options menu / Funds click Add (or Edit to amend an existing fund).

Enter the fund name and select a fund type, if the type is either unrestricted or endowment select a fund category. The software will present the General fund by default when posting transactions or viewing reports, you can change the default by ticking the ‘make default’ box on the fund of your choice.

The SORP requires disclosure of the particulars of each type of fund: how it has arisen, the purpose and any restrictions imposed, this detail is stored with the individual fund and reported in the notes to the accounts. Click the Purpose of fund tab and enter the details of the fund.

The software automatically rounds figures to the nearest pound, reporting any rounding difference into pre-set rounding accounts in the SoFA and balance sheet. Each fund has its own set of rounding accounts to allow you to deal with odd balances appearing in individual funds and fund types on the SoFA. Default rounding accounts are pre-set but can be changed by clicking the Rounding Accounts tab and selecting the required accounts for the SoFA and balance sheet.

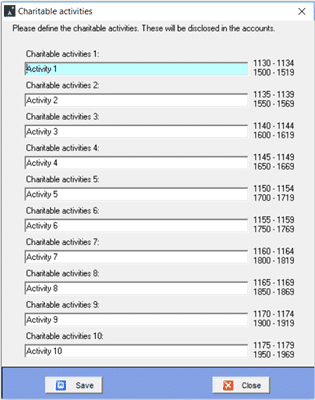

Charitable Activities

Charitable activities are the main services or programmes provided by the charity, there are sections in the ledger dedicated to the incoming resources and expenditure allocated to these activities. The activities and associated figures are then disclose in the note to the accounts. You can create up to 10 charitable activities and on setting up a new charity you will be prompted to define them. Once the charity has been created you can get back to the charitable activities by clicking the Report Formatting menu / Asset and ledger code groups / Charitable activities:

Structure of the Ledger

Before we look at support costs, we need to consider how these and other types of expense are reported in the notes to the accounts. The SoFA gives an analysis of resources expended based on the nature of the activities undertaken. The notes to the accounts gives an analysis of the underlying balances in the ledger. The expenses section of the ledger has been designed to group the individual expense accounts under a more general heading, this is to avoid disclosing every single expense account in the notes.

For example: the ledger section ‘cost of generating donations and legacies’ (voluntary income) has 6 main accounts: donations, legacies, grants receivable, subscriptions and gifts in kind. Each main account has a set of sub-accounts covering items that must be disclosed in various notes to the accounts (such as staff costs and net income/expenditure notes). You can create further subaccount codes or you can post transactions directly to the main account if no further analysis is required. The cost of generating voluntary income note would then report cost of generating voluntary income based on the main account groupings rather than the detail in each individual subaccount. Of course, you can also rename the main accounts should you wish to report the main accounts differently.

The SORP requires the notes to the accounts to disclose support costs as well as direct costs associated with the various activities; each expense section, therefore, has a batch of support costs allocated to it. The software does not automatically apportion support costs; you are required to post pre-apportioned values to the various accounts, these are disclosed along with the method of apportionment in the notes to the accounts.

The ledger contains 10 main accounts covering support costs, each has a set of sub-accounts covering items that must be disclosed in various notes to the accounts (as above), you can add further sub-accounts or you can post directly to the main account; the analysis of support costs note will report support costs at main account level. We have defined the first 4 support main accounts as management, finance, IT and human resources, these represent functional areas rather than individual support costs, of course, the main account descriptions can be changed to suit the requirements of the individual charity.

Defining Support Costs

Bearing in mind the above, you can define support costs once the charity has been created by clicking Report Formatting / Asset and ledger code groups / Support costs.

Posting Transactions

Transactions can be posted via journals or you can capture balances via Adjust Balances in the usual way, the only difference being you must select the fund you want to post to. The software will default the fund to either the General fund, or whichever fund you have specified is the default.

When working with journals you must post to a single fund; you cannot post to multiple funds in the same journal. This ensures the fund stays in balance.

Transfers between Funds

Transfers between funds are posted as any other transaction, but it must be remembered that each fund must remain balanced in its own right, here are some sample accounting entries covering a bank transfer between 2 funds:

| Account code | Account | Debit | Credit | Fund |

| 8010 | Transfers between funds | £1000 | A | |

| 5240 | Bank account | £1000 | A | |

| 8010 | Transfers between funds | £1000 | B | |

| 5240 | Bank account | £1000 | B |

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.