PTP CT - Box 530 is not populating with the amount of the R&D tax credit claim

Article ID

kba-03797

Article Name

PTP CT - Box 530 is not populating with the amount of the R&D tax credit claim

Created Date

16th September 2021

Product

Problem

Box 530 is not populating with the amount of the R&D tax credit claim

Resolution

HMRC made a change in April 2021 regarding the circumstances in which box 530 is populated in conjunction with the introduction of the CT600L form. Previously, box 530 was for the amount of the Research & Development (R&D) tax credit claimed. Since the introduction of the CT600L box 530 is now populated with the amount of R&D set off against other liabilities in this period and is pulled from box L210 on the CT600L.

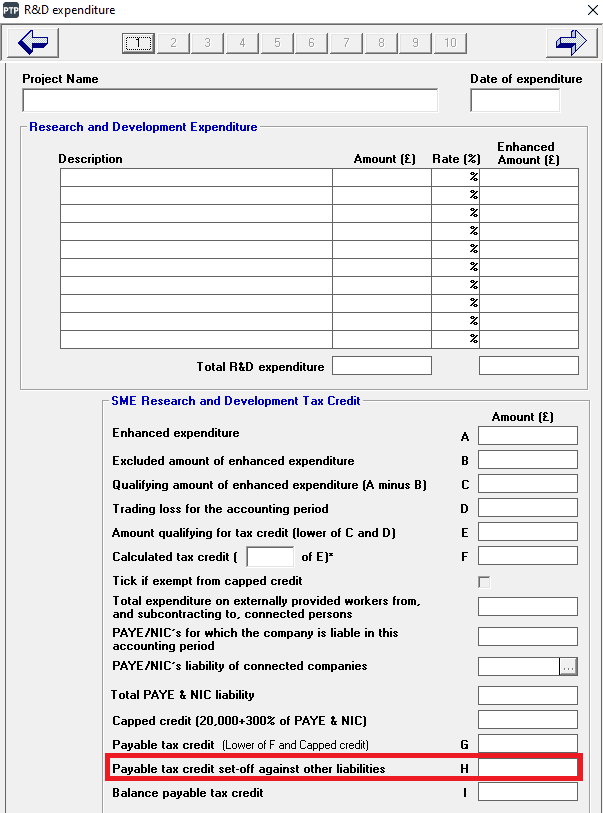

Within the data entry screen this equates to box H Payable tax credit set-off against other liabilities. Box H is manual entry and flows through to box 530 via box L210 on the CT600L. This has the effect of reducing the value in Box I Balance payable tax credit which is auto calculated and will flow through to box 875.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.