PTP TR - Self Employment entries where there is a change of Accounting Period as a result of Basis Period Reform

Article ID

kba-03844

Article Name

PTP TR - Self Employment entries where there is a change of Accounting Period as a result of Basis Period Reform

Created Date

16th May 2024

Product

Problem

As a result of the Basis Period Reform, many taxpayers will be amending their Accounting Period ends to match the new Basis Period.

Resolution

This example relates to a taxpayer who previously had a December year end so the last accounts were made up to 31/12/2022. The new year end is going to be 31st March. The following is the data entry required for the 2023-24 return.

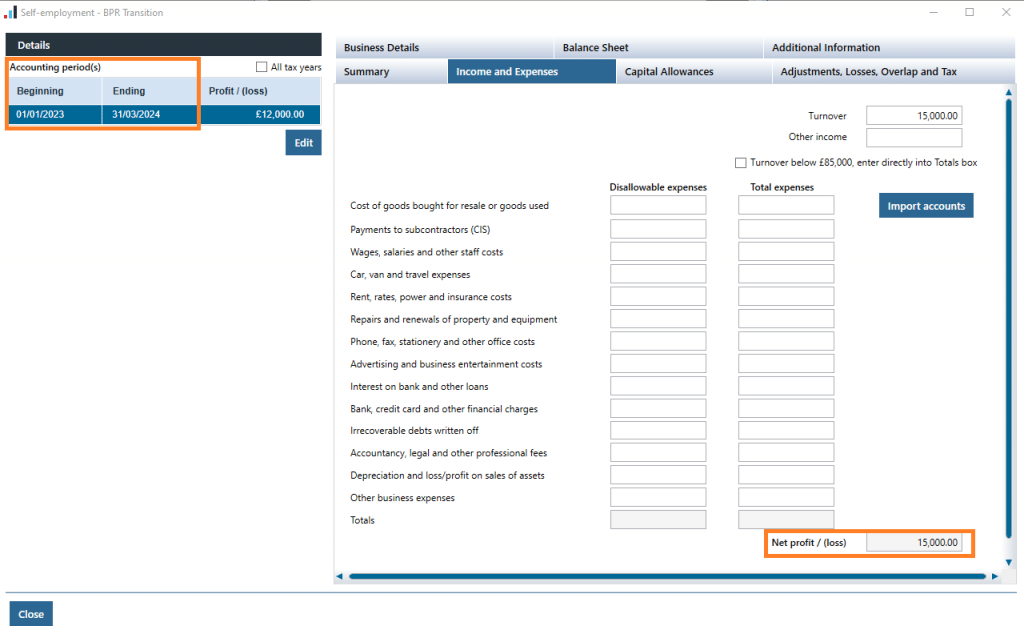

1. The Accounting Period is entered as 01/01/2023 to 31/03/2024

2. All data entry for ‘Income and Expenses’ and ‘Capital Allowances’, should relate to the extended accounting period. In this example there is a profit of £15000 for the 15 month period.

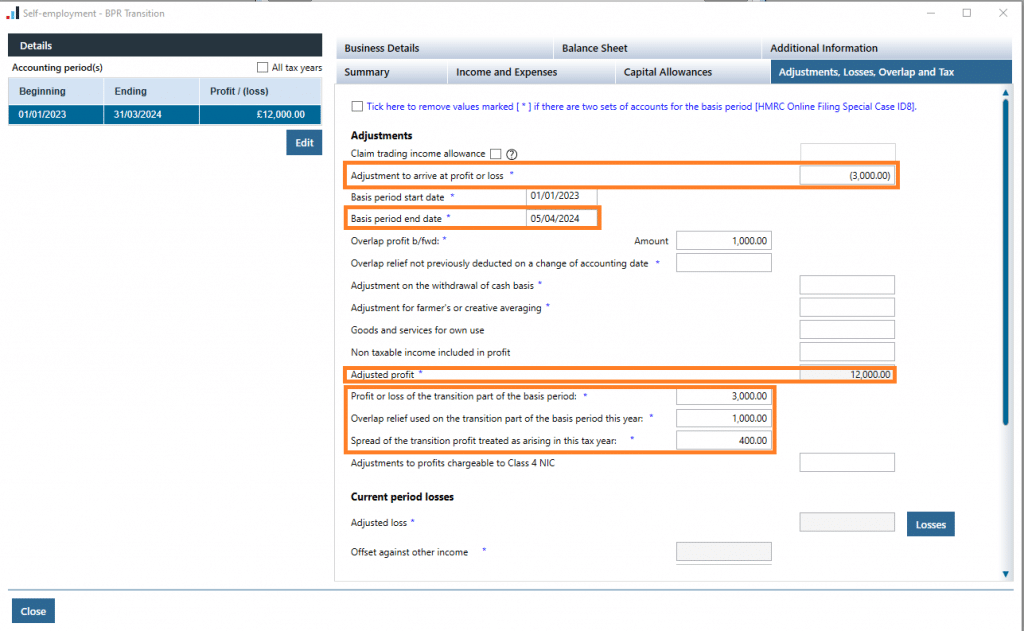

3. An ‘Adjustment to arrive at profit or loss’ is made in the tab for ‘Adjustments, Losses, Overlap and Tax’ to arrive at the figure for the Standard Profit i.e. to apportion the profit to the correct 12 month figure.

4. The Basis period end date is the end of the tax year 05/04/2024.

5. The transition portion of the profit is entered in ‘Profit or loss of the transition part of the basis period’

6. Any overlap relief to be deducted is entered in ‘Overlap relief used on the transition part of the basis period this year’. (Please note if the overlap relief b/fwd is higher than the transition profit, the higher figure should be entered here and the software will automatically utilise the remainder against the standard part of the profit.)

7. The ‘Spread of the transition profit treated as arising in this tax year’ must be a minimum of 20% of the ‘Profit or loss of the transition part of the basis period’ minus ‘Overlap relief used on the transition part of the basis period this year’, but a higher figure could be entered if desired.

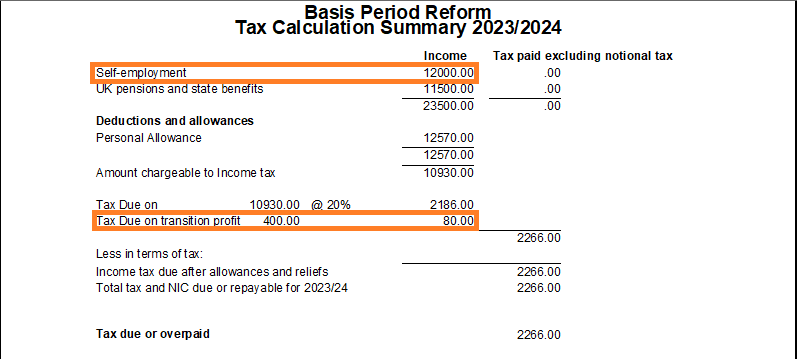

Within the Tax Calculation Summary, the Standard Profit and Transition Profit will show in separate places. Only the Standard Profit will be listed in the Income section at the top. The Transition Profit shows as part of the tax calculation breakdown below.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.