PTP TR - Self Employment entries for Basis Period Reform without any change of Accounting Period

Article ID

kba-03845

Article Name

PTP TR - Self Employment entries for Basis Period Reform without any change of Accounting Period

Created Date

17th May 2024

Product

Problem

Under the Basis Period Reform measures, all businesses' basis periods will be aligned to the tax year and all outstanding overlap relief will be given on transition to the tax year basis.

Resolution

If the business already has an Accounting Period year end between 31st March and 5th April there is no change required. If the business is retaining the original Accounting Period year end, the following describes the data entry required in PTP Tax Platform. (If the Accounting Period year end is also changing as a result of Basis Period Reform please see https://www.iris.co.uk/support/knowledgebase/kb/kba-03844/).

This example relates to a December year end so accounts will be produced for the 12 months from 01/01/2023 to 31/12/2023. The following is the data entry required for a 2023-24 return.

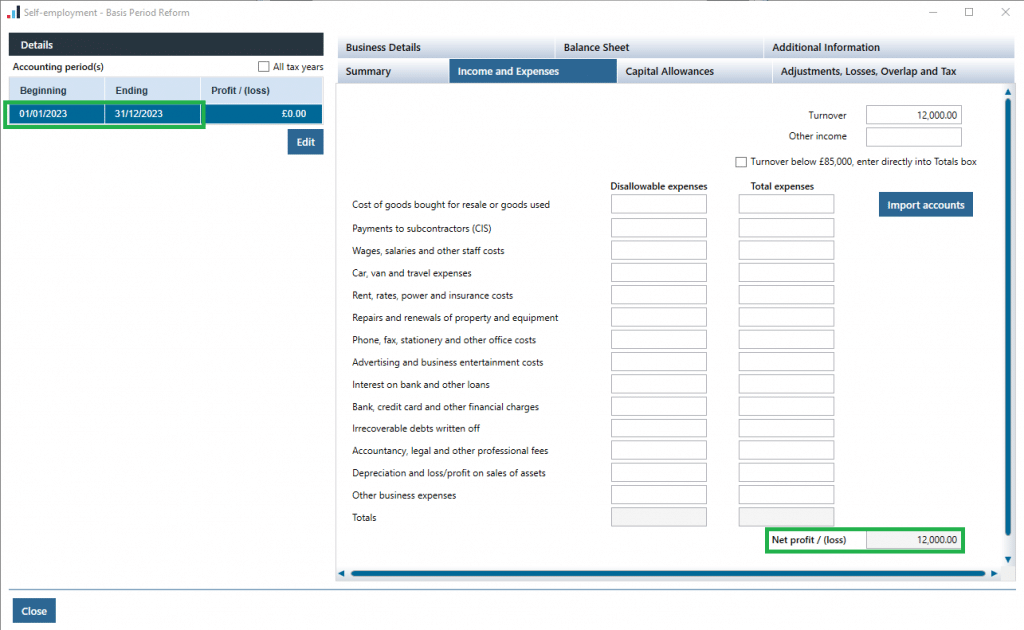

1. The Accounting Period is entered as 01/01/2023 to 31/12/2023

2. All data entry for ‘Income and Expenses’ and ‘Capital Allowances’, should relate to this Accounting Period. In this example there is a profit of £12000 for the 12 month period. This is the standard part of the profit for the basis period.

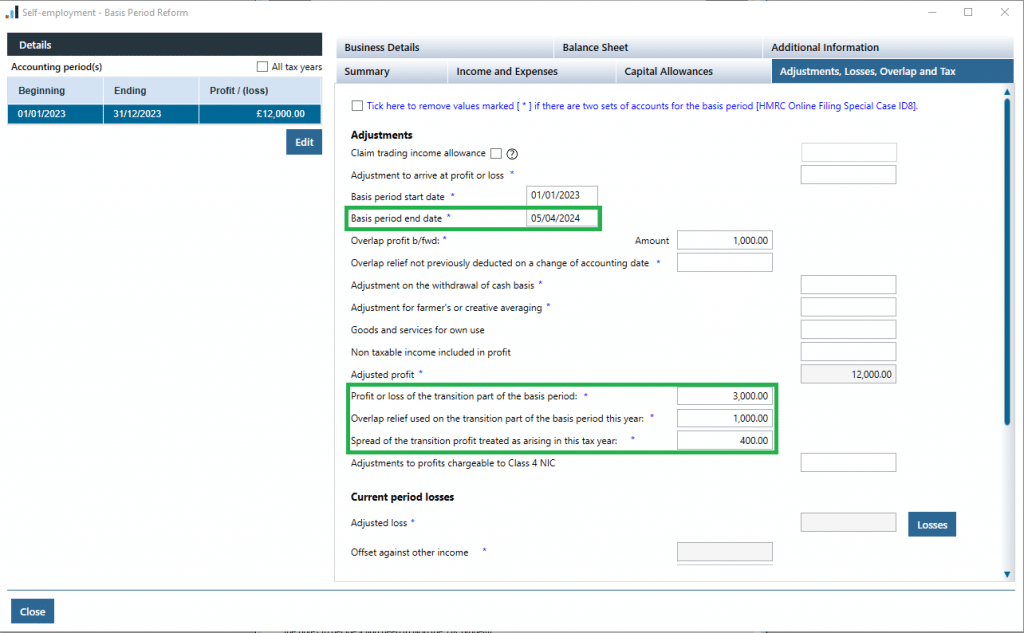

3. The Basis period end date is the end of the tax year 05/04/2024.

4. The transition portion of the profit is entered in ‘Profit or loss of the transition part of the basis period’. As the accounts up to 31/12/2024 may not have been completed yet, this may need to be a provisional figure.

5. Any overlap relief to be deducted is entered in ‘Overlap relief used on the transition part of the basis period this year’. (Please note if the overlap relief b/fwd is higher than the transition profit, the higher figure should be entered here and the software will automatically utilise the remainder against the standard part of the profit.)

6. The ‘Spread of the transition profit treated as arising in this tax year’ must be a minimum of 20% of the ‘Profit or loss of the transition part of the basis period’ minus ‘Overlap relief used on the transition part of the basis period this year’, but a higher figure could be entered if desired.

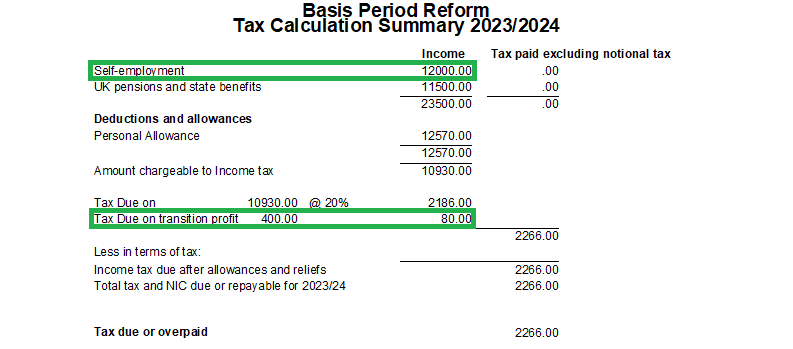

Within the Tax Calculation Summary, the Standard Profit and Transition Profit will show in separate places. Only the Standard Profit will be listed in the Income section at the top. The Transition Profit shows as part of the tax calculation breakdown below.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.