KBA-3851 PTP TR - Partnership entries for Basis Period Reform with two sets of accounts

Article ID

kba-03851

Article Name

KBA-3851 PTP TR - Partnership entries for Basis Period Reform with two sets of accounts

Created Date

28th October 2024

Product

Problem

Partnership entries for Basis Period Reform with two sets of accounts

Resolution

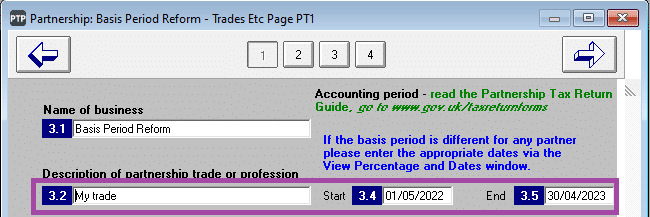

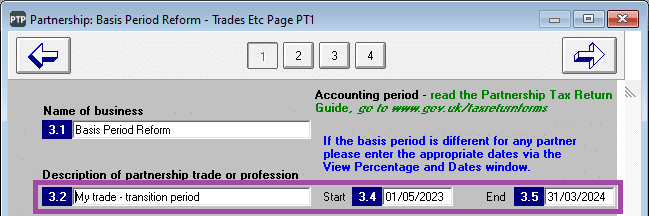

This example relates to a taxpayer who previously had an April year end so the last accounts were made up to 30/04/2022. The new year end is going to be 31st March and two sets of accounts have been produced. The following is the data entry required for the 2023-24 return. In this example there is a profit of £24000 for the standard 12 month period up to 30/04/2023 and £22000 for the transitional 11 month period up to 31/03/2024.

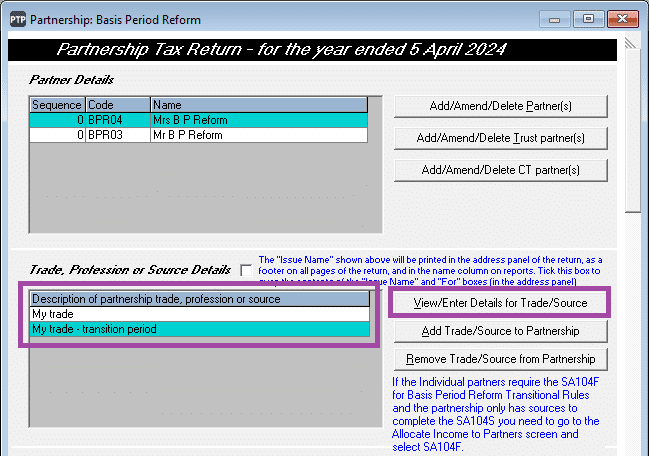

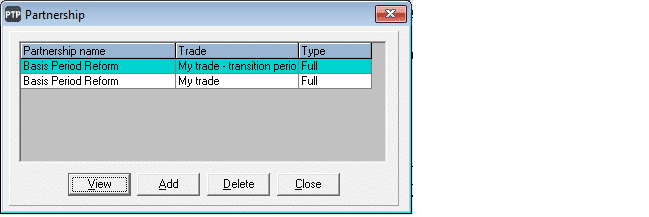

- In PTP Partnership Return, a second accounting period is added in the same way as a second trade.

2. Select the button View/Enter Details for Trade/Source to complete each set of trade pages in turn.

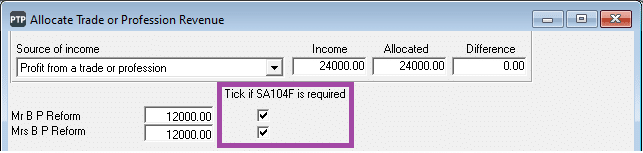

3. If there is only Trade income a new tick box will appear in the screen to allocate the income to the partners (please note this tick box was introduced in the May release, 24.1.231, and will only appear if the software would ordinarily default to the short pages on the Individual return).

4. In the Individual return for each partner there will be two Partnership supplementary pages, one linked to each set of figures from the Partnership.

5. Complete the set of pages for the transition period first in order to allocate any overlap relief in the correct order i.e. against transition profits first and standard profits second.

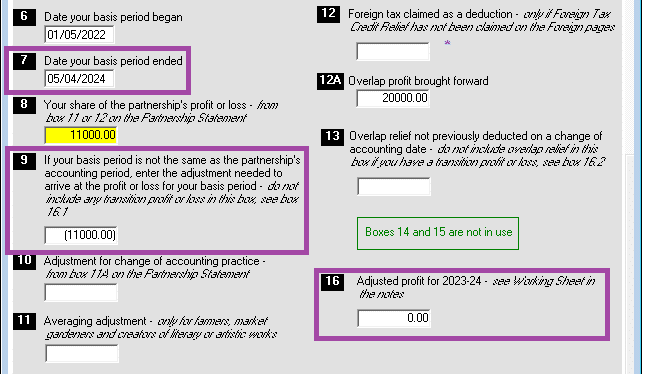

6. The Basis period end date is the end of the tax year 05/04/2024.

7. An adjustment is made in box 9 to ensure Adjusted profit for 2023-24 is nil as this period is dealing purely with transition profits which will be entered separately on page 2.

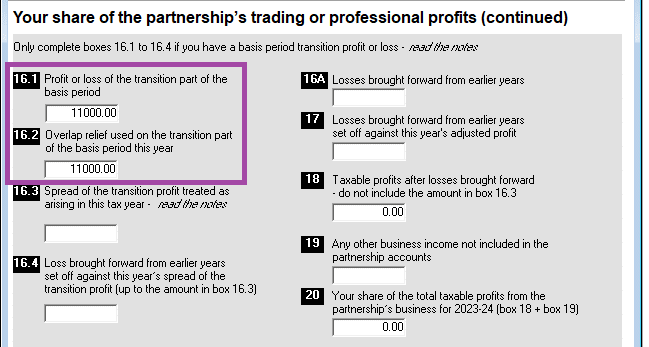

8. Enter the transition profit in box 16.1. If the overlap relief is greater than the amount of profit, ensure to restrict the entry in 16.2 to be the same value as the transition profit. The remainder will be utilised in the other set of Partnership pages against the standard profit.

If the overlap relief were less than the transition profit, there would be an entry in box 16.3 for Spread of the transition profit treated as arising in this tax year which would flow through to the tax calculation. Box 16.3 must be a minimum of 20% of (box 16.1 minus box 16.2), but a higher figure could be entered if desired.

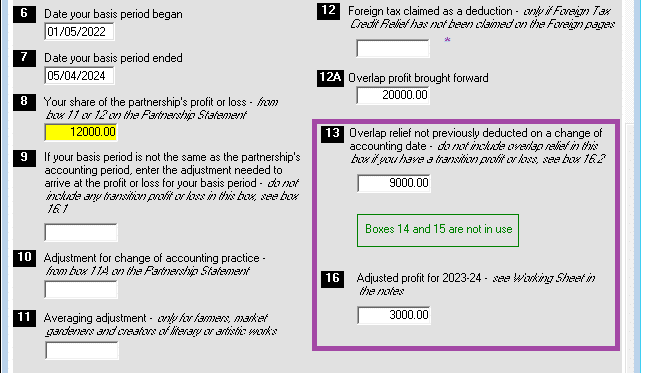

9. Now complete the set of pages for the 12 month accounting period with the standard portion of the profit. In this example the overlap relief available was £20000, £11000 of which has already been offset against the transition profits, leaving £9000 to be used against the standard profit.

If the amount of overlap profit brought forward exceeded the total of both the standard and transition profits, utilise it against the transition profits first and enter all of the remainder in box 13 on the pages with the standard profit. This will generate a loss which can be utilised as appropriate.

10. When submitting a Partnership return with two trades/periods please follow the instructions here https://www.iris.co.uk/support/knowledgebase/kb/kba-03017.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.