Personal Tax - 3001 8219 amount in box fps16 must equal fps8+fps9. Share of Profits SA104F must equal

Article ID

personal-tax-3001-8219-amount-in-box-fps16-must-equal-fps8fps9

Article Name

Personal Tax - 3001 8219 amount in box fps16 must equal fps8+fps9. Share of Profits SA104F must equal

Created Date

30th October 2024

Product

Problem

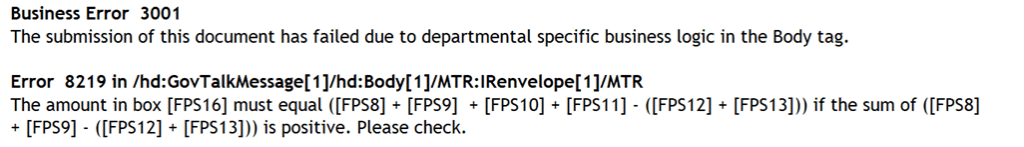

IRIS Personal Tax - 3001 8219 amount in box fps16 must equal fps8+fps9 AND you may get 3001 8219 amount in box fps16 must equal fps8+fps9. Share of Profits SA104F must equal

Resolution

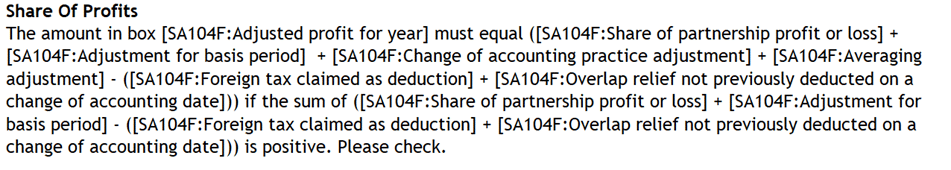

When generating you may get a validation: Share of Profits Amount in box SA104F Adjusted profit for year must equal

When submitting online you get a 3001 8219 amount in box fps16 must equal fps8+fps9 etc.

There are three possible causes, please check each one:

1.You must first check the Trade comp profit, is there a £1 different compared to the profit showing in the SA100 box 16 page FP1 etc?. If there is a difference then this has been confirmed as a defect and is fixed on IRIS version 24.3.0. Once updated regenerate the Tax return and submit.

OR

2. If there is a partnership end date (eg within 2024) and overlap relief entered. The overlap relief can only be used in 2024 tax year which is why the validation message is appearing. Overlap relief cannot be carried forward to the 2025 tax year. To file the return online you cannot have an amount entered under overlap relief. However, you must decide whether or not to put the overlap relief on the return, we would not be able to advise you on this. If you are unsure, we would suggest contacting HMRC for further guidance on the matter.

OR

3. If there a overlap that has been entered twice – one for ‘Trading Income’ and again for ‘Other Income’ – and therefore has been claimed twice. Trading income overlap must be utilised against any transitional part profits, which is automated by the software. By adding the second Other Income overlap value, and setting it against other income, it has also reduced the adjusted profit value in box 16 and this is what triggers the validation, you will need to revise and remove the other overlap claim value. (There is no fix or workaround and if you do remove it then add it under Reliefs/Additional information/ explain the value here)

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.