Personal Tax- 3001 8412 Entry in CGT30(22), complete CGT29(21). Entry in SA108 tax on gains RTT already charged

Article ID

personal-tax-3001-8412-entry-in-cgt30-complete-cgt29-entry-in-sa108-tax-on-gains-rtt-already-charged

Article Name

Personal Tax- 3001 8412 Entry in CGT30(22), complete CGT29(21). Entry in SA108 tax on gains RTT already charged

Created Date

5th October 2022

Product

Problem

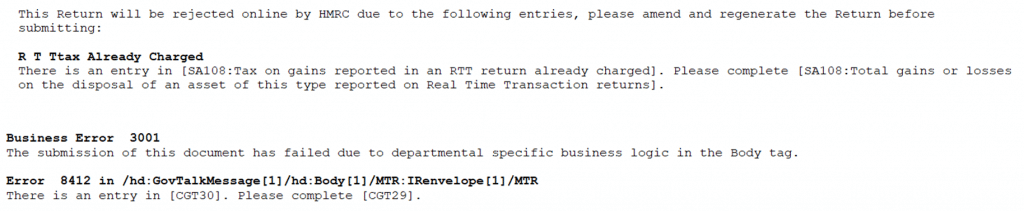

IRIS Personal Tax- 3001 8412 Entry in CGT30 or 22, complete CGT29 or 21. Entry in SA108 tax on gains RTT already charged

Resolution

IF you generate a Return and Submit it – you can get these 2 errors linked to Capital gains boxes 30/22 and 29/21

Look for any Capital Gain Tax already paid Real time Transactions entries: Go to Dividends and then Assets or Shareholdings – then look under Disposals/Events for the tax paid entry. Now run the Capital gain tax comp and look up the asset/share AND run a Draft return and look up ‘Proceeds’ and ‘Allowable costs’ on CG1 and CG2.

If for example: this asset/share has the same Purchase Price and Disposal Value (eg identical values) then no gain or loss is created and you cannot claim the Tax already paid Real time Transactions. There has to be a loss or gain on the disposal.

You can either remove the tax paid value and declare it under Additional Information OR contact HMRC support on where they recommend to show it.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.