Personal Tax- Period Reform 2024: Make election to bring in all profits to current tax year and not spread tax over 5 years + OPT OUT

Article ID

personal-tax-basis-period-reform-2024-how-to-make-an-election-to-bring-in-all-of-the-profits-to-the-current-tax-year-and-not-spread-the-tax-over-5-years

Article Name

Personal Tax- Period Reform 2024: Make election to bring in all profits to current tax year and not spread tax over 5 years + OPT OUT

Created Date

11th July 2024

Product

Problem

IRIS Personal Tax- Basis Period Reform 2024: How to make an election to bring in all the profits to the current tax year and not spread the tax over 5 years. OPT out option?

Resolution

Please do the following to resolve your issue: –

- Go to Personal Tax and load the client

- Income Tab | Trade Profession or Vocation | Sole Trade or Partnership

- Double click on the Accounting Period

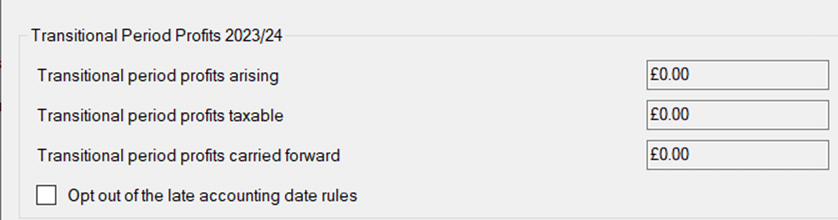

- Transitional Period Profits – tick the magnifying glass

- Go to the Step 5: Apportioned Transition Profit – tick the box and manually enter the FULL/edited amount (If you DO NOT want all to be taxed in one year then remove the tick entry and let PT auto calculate the value)

- Run Tax Comp – at the bottom the FULL or edited amount will be listed and then be taxed. (The % rate of tax is not default set at 20/40% then read this KB)

- Please Note: The minimum amount that can be elected is 20%.

- If you expected transitional profits to show and its not been overridden as in step 5) then read this KB and scroll to the bottom for ‘I have the correct periods but still no transitional profits show?

How to Opt out

- Go to Personal Tax

- Income Tab | Trade Profession or Vocation | Sole Trade or Partnership

- Double click on the Accounting Period

- Transitional Period Profits – tick the magnifying glass

- At the very bottom tick ‘Opt out’

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.