Personal Tax- Benefit entry missing from Employment income

Article ID

personal-tax-benefit-entry-missing-from-employment-income

Article Name

Personal Tax- Benefit entry missing from Employment income

Created Date

15th September 2022

Product

Problem

IRIS Personal Tax- Benefits (maybe from P11D) are missing from Employment income total on Tax comp (eg not being included)

Resolution

This can affect any benefit under employment – including cars etc where its value is not totaling up with the employment income.

1.Open the benefit and look at the field ‘Amount made good/which tax deducted’– a entry here reduces the benefit value. If you remove this then the benefit will appear. If still missing then go to step 2.

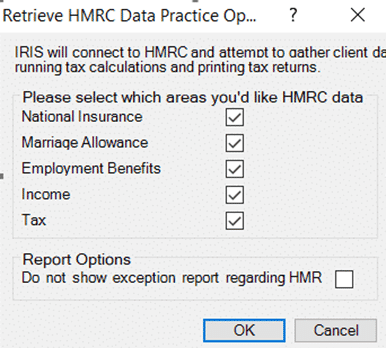

2. Setup/ Retrieve HMRC data practice options, the top five boxes must be all ticked.

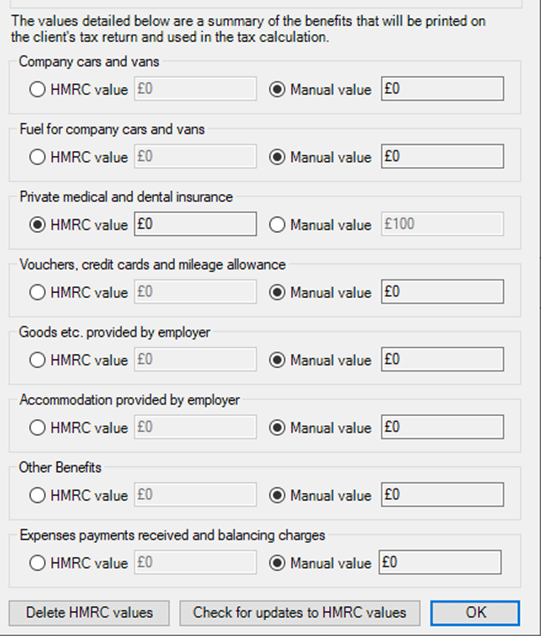

3. Go to Employment and then Benefits, click the relevant employment company at top and then click View benefit summary on very bottom.

4. Switch to manual and PT will now have the benefit added to the employment income on the Tax comp etc

This is a HMRC decision where their 0/NIL value will supersede your manual value.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.