Personal Tax- Business Asset Disposal Relief BADR (Entrepreneurs Relief)

Article ID

personal-tax-business-asset-disposal-relief-badr-entrepreneurs-relief

Article Name

Personal Tax- Business Asset Disposal Relief BADR (Entrepreneurs Relief)

Created Date

6th October 2022

Product

Problem

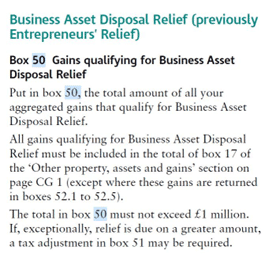

IRIS Personal Tax- Business Asset Disposal Relief BADR (Entrepreneurs Relief) - why its not all taxed at 10% or 20%. Box 50 and 50.1 CG3 and Annual Exemption

Resolution

This relief can be called Entrepreneurs Relief or Business Asset Disposal Relief (BADR)

1.Load the client and relevant period

2. Dividends and Capital Assets

3. Create a Asset/Share/Other Capital gain – When you dispose the asset/share/other, tick the option Entrepreneurs Relief OR Business Assets which could trigger the 10% tax calc (depending if the rules below are met). Entering BADR under ‘Claim relief’ (eg under 24 Other) will not trigger the 10% calc and only shows as a relief.

4. Run the Capital Gain comp to see the results and check values on page CG3 Box 50 – it will show the total BADR claim. Also on Box 50.1, this will show the Box 50 disposal value if its below the allowance limit (up to the £1 million limit).

5. PT is following HMRC rules which states that ‘BADR’ is given on the amount before Losses and Annual Exemption (AEA) and NOT the Net total capital gains in the year (this cannot be overridden). Read notes below if you want to edit the BADR claim.

Why it taxes some at 10% when it should be part/all at 20% tax

Users have run the Capital Gain comp and they see some of the CG income still being taxed at 10% when they expected part/all at 20% (for example all of the BADR has been claimed and thus cannot claim any at 10%). In all of these cases, when we tested against the HMRC Test Case Generator it matches the same calculation from PT. So the PT CG tax is correct and meets HMRC rules.

Why it taxes at 10%/20% rather then just 10% only

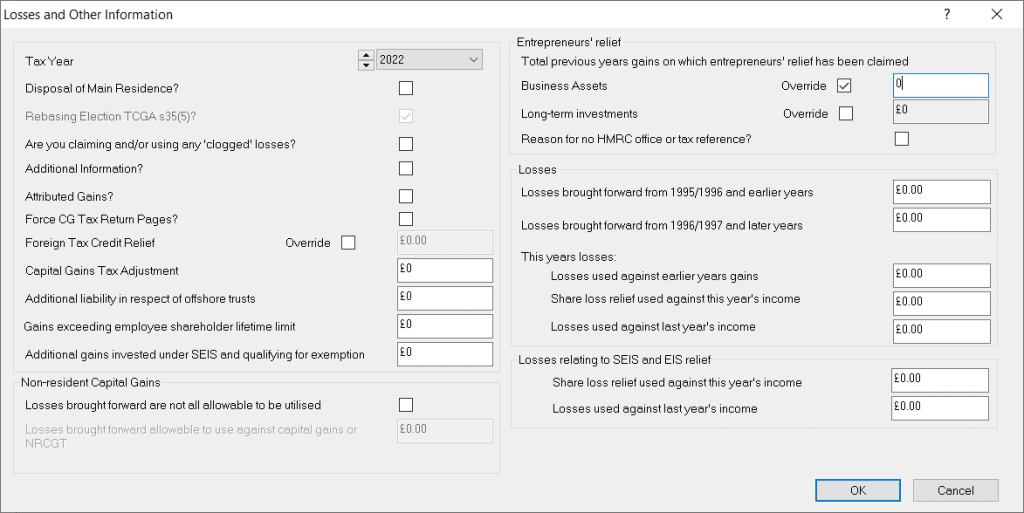

This is normally because the client has reached the maximum £1 million BADR allowance OR you have not ticked BADR for all the assets. You can check by going to Dividends and Capital Assets, Edit, Losses and Other Information – Top right ‘Business Assets’, and see the total b/f BADR claim. Then run the CG comp and add the years current BADR claim to it, it may have reached/reaching the max £1 million.

PT will automatically record the BADR(Entrepreneurs Relief) claim for each year (if any) and bring it forward to the next year. Once the BADR claim in current year and the B/f BADR reaches £1 million together, then any current year asset claiming BADR is automatically restricted as it cannot go above £1 million (On the CG tax comp – you expected a higher claim at 10% but it shows a less value claim and taxing more at 20% etc).

Claiming Residential property AND Entrepreneurs Relief/Business Assets BADR on 1 asset

1. If you submit both claims under 1 asset you may get a 3001 6492 error. So rather than just one property asset – split it into two assets.

2. First asset will only be ticked Residential property

3. The other asset will only be ticked claiming Entrepreneurs relief BADR, this must be entered under ‘Other Capital Gains’

4. Manually apportion the purchase price / disposal etc between the two assets (eg split between the part qualifying for BADR and the part qualifying for residential property)

5. Capital assets, Edit, Losses and other info, Additional info and explain its actually 1 property This is a HMRC restriction that a Residential asset cannot report the ENTREP (BADR) relief in the Residential section and this workaround is advised from the HMRC site. You then cannot claim BADR on the asset which is not ticked BADR relief.

How to edit the BADR claimed amount (claim more or restrict the 10%)

Go to Capital assets, Edit, Losses and Other information. Tick Business Assets ‘Override‘ (on top right) and adjust the b/f BADR value (eg reduce it to claim more BADR OR increase value to restrict the BADR), then run the CG tax comp again. It is your decision on overriding this automatically calculated box as it is the total amount of Entrepreneurs Relief (BADR) claimed in previous years and HMRC may query why you edited the value (as they may have records of all prior year BADR claims).

Warning if you do use the BADR override: The overridden value will also be carried forward to next year etc, so we recommend you manually keep a note if you plan to revisit the BADR value in future. Also if you have a unknown BADR value in a year which dosnt seem to add up, then check the prior years to see if this was manually overridden in past years which is affecting future years.

If its a new client but they have BADR claims in the past to report to you- then Tick Override and enter what BADR they have already claimed (thus restricting the BADR amount) and shows on 50.1 etc. Add an additional note explaining explaining his manual entry.

The example below is overriding it and changing the b/f BADR back to 0/NIL claims (so you can claim the full £1 million).

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.