Personal Tax- Carried forward Transitional Profits from 2024 are missing in 2025?

Article ID

personal-tax-carried-forward-transitional-profits-from-2024-are-missing-in-2025

Article Name

Personal Tax- Carried forward Transitional Profits from 2024 are missing in 2025?

Created Date

10th April 2025

Product

Problem

IRIS Personal Tax- Carried forward Transitional Profits from 2024 are missing in 2025?

Resolution

This is an intermittent DEFECT in IRIS version 25.1.0 affecting the 2025 tax year. The IRIS Development is investigating this and we will update this KB once we have further news.

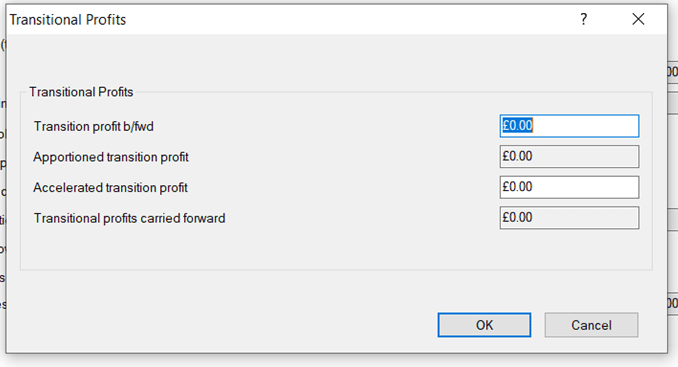

You have a client with Transitional Profits carried forward from the 2024 year into 2025 (So it can be taxed over a period of years). When you load 2025, Edit, Bring forward Data, and complete the process. Open the trade period, at the bottom click ‘Transitional profits’, this new screen (see below) will appear and the expected carried/brought forward Transitional Profit box is £0.00.

Workaround: Go back to 2024, note the carried forward Transitional Profit value. Change to 2025 year and manually type in the value under the Transition profit b/fwd box and OK, it will now apply the profit under the Tax Comp etc.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.