Personal Tax- Residential Property CG1 'Box 8 Claim' and 'Box 13 Carried Interest'

Article ID

personal-tax-cg1-box-8-claim-and-box-13-carried-interest

Article Name

Personal Tax- Residential Property CG1 'Box 8 Claim' and 'Box 13 Carried Interest'

Created Date

21st December 2022

Product

Problem

IRIS Personal Tax- Residential Property CG1 'Box 8 Claim' and 'Box 13 Carried Interest'

Resolution

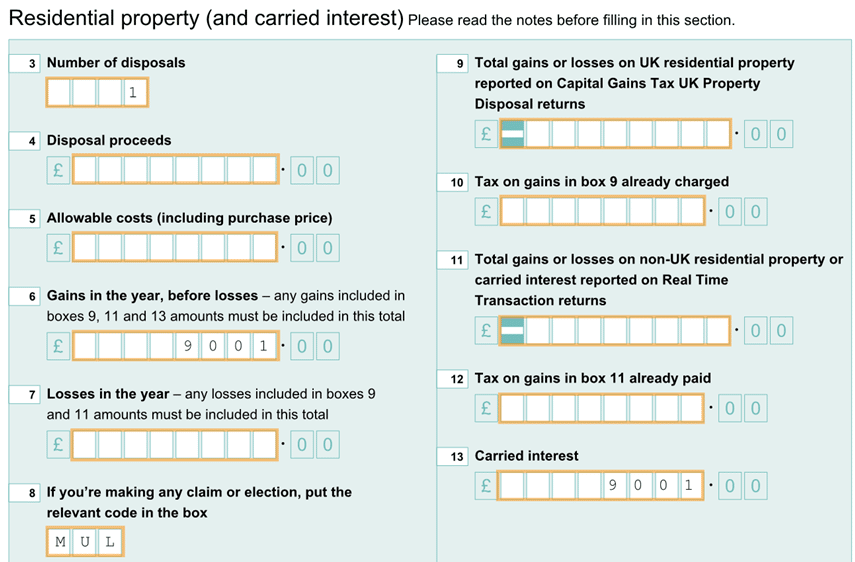

Box 8 Claim: Edit – Capital assets – Asset or a Other Capital gain – Add – Tick Residential (property) and tick the box for Claim Relief and enter type and value.

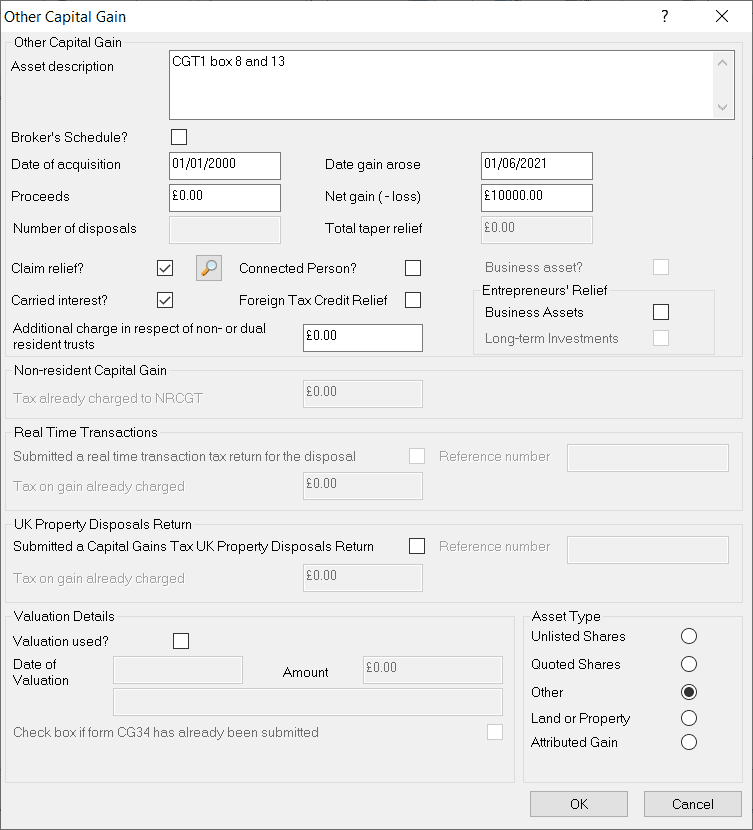

Box 13 Carried Interest: Edit – Capital assets – it has to be a Other Capital gain- Add- and select ‘OTHER’ and now tick ‘Carried interest’ and enter net gain/loss and dates

Note: If you also make a Relief claim (box 8) this relief value will automatically be deducted from the Box 13 Value.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.