Business Tax- Claim Indexation (RPI) on Capital disposals

Article ID

personal-tax-claim-indexation-rpi-on-capital-disposals

Article Name

Business Tax- Claim Indexation (RPI) on Capital disposals

Created Date

24th May 2023

Product

Problem

Resolution

Business Tax- Claim Indexation (RPI) on Capital disposals

Personal Tax has no indexation provided because HMRC rules states its only for BT and not PT (which also ended 2018 as well)

1 Log on to IRIS Business Tax and select the client and correct year

2. Go to Edit | Capital Assets

3. Click the Assets option then click Add. Enter in a description, date acquired and an amount paid and click on OK.

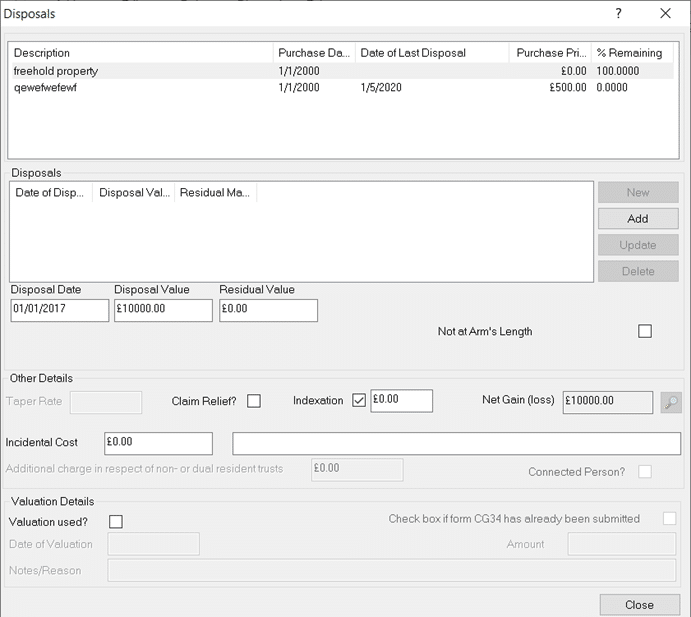

4. Click the Dispose button

5. Enter a disposal date and disposal value and click Add. The indexation will be calculated automatically. If no indexation has been calculated please ensure that the disposal date has an associated RPI value in set up | retail price index. Please Note: Entries made in the ‘Other Capital Gains’ section will not receive indexation allowance. If the asset is disposed before Dec 2017 then IRIS should auto calc the indexation.

If you want to edit the Indexation calculation: Under the disposal screen , Open the asset – there is a Indexation button – tick this and enter it in manually to adjust the value to what you want. Example below shows its changed to £0.

For the Indexation values: Go to Setup/RPI and the table with values will show – warning the the table only goes to 1997 and not before.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.