Personal Tax- (Claim to FTCR amount chargeable) Amount SA106 and SA105 PRO11.1 OR Must Exceed

Article ID

personal-tax-claim-to-ftcr-amount-chargeable-amount-sa106-pro11-1

Article Name

Personal Tax- (Claim to FTCR amount chargeable) Amount SA106 and SA105 PRO11.1 OR Must Exceed

Created Date

21st February 2022

Product

IRIS Personal Tax

Problem

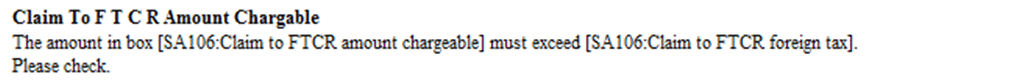

IRIS Personal Tax- Get validation of (Claim to FTCR amount chargeable) Amount SA106, and SA105 PRO11.1 OR you get 'Must Exceed'

Resolution

Check all UK or Foreign property entries:

1) No negative expenses are allowed

2) If you have foreign tax paid BUT the property was already in loss – you cant increase the loss by this tax paid. You need to remove the tax paid entry. If you need to declare this tax paid then either contact HMRC or add it as a note under Additional information.

3) If any tax paid exceeds the income, then this needs to be reduced. If you need to declare this tax paid then either contact HMRC or add it as a note under Additional information.

4) Adjust figures in expenses for all properties so that they are rounded up or down to the nearest even number

Check all UK/Foreign income under non property sections (like Employment):

1)You have claimed tax paid but it exceeds the income. Eg claiming Foreign Tax paid (FTCR) but its value is more then the income

If you get the SA106 FTCR ‘Must Exceed’ warning – Please check all ‘Foreign tax paid’ and ‘Foreign Tax credit’ entries, it cannot exceed the income OR add extra loss onto a current loss which exists has tax paid which increases the loss (which HMRC doesn’t allow)

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.