Personal Tax- Collect Unpaid tax via Tax code/Collect non PAYE for next year via Tax code

Article ID

personal-tax-collect-unpaid-tax-via-tax-code-collect-non-paye-for-next-year-via-tax-code

Article Name

Personal Tax- Collect Unpaid tax via Tax code/Collect non PAYE for next year via Tax code

Created Date

13th October 2022

Product

Problem

IRIS Personal Tax- Collect Unpaid tax via Tax code/Collect non PAYE for next year via Tax code

Resolution

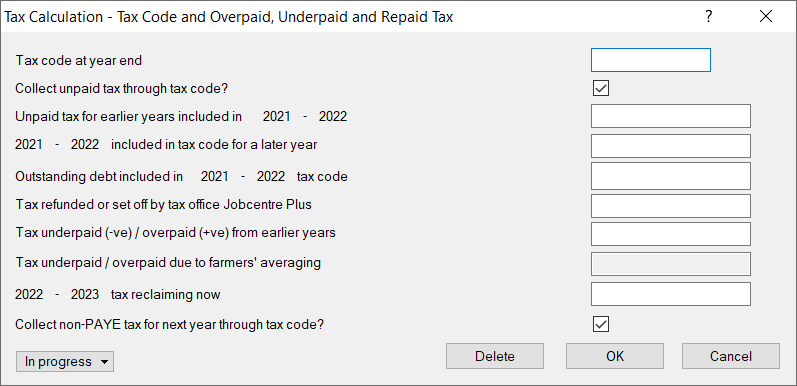

Tax code at year end – The client ‘Tax code’ entered into Personal Tax is just for information purposes it will not have any bearing on the tax comp and tax return.

Collect unpaid tax through tax code [Y/N] – if the client pays tax through the PAYE scheme then any amount owing, up to a maximum of £3,000 (2,000 up to 2010-11, 1,000 1996-97 to 1999-2000) , may be collected through the tax code. IRIS will assume that this is not the case. Enter Y to collect tax through the PAYE code. Leave blank or enter N to tick box 2 on TR5 and the tax will be collected as a balancing payment on 31st January following the end of the fiscal year.

If the return is filed after 31 October (2007 : 30th September), the Revenue will not normally allow the underpayment to be collected through the PAYE code. However, tax returns submitted electronically have a later deadline.

The tick automatically appearing in box 2 on TR5 is placed there specifically to ensure that the calculation of payments on account is correct. Unless the payment is to be collected through PAYE do not untick this box. The tick is appropriate in all cases where tax in not being collected through PAYE, including clients that have no earned income.

Collect non- PAYE tax for next year through the code [Y/N]- tick where necessary

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.