Personal Tax- Exception Class 2 NIC by HMRC was £0.00 and Manual Value £XXX

Article ID

personal-tax-exception-class-2-nic-by-hmrc-was-0-00

Article Name

Personal Tax- Exception Class 2 NIC by HMRC was £0.00 and Manual Value £XXX

Created Date

3rd January 2023

Product

Problem

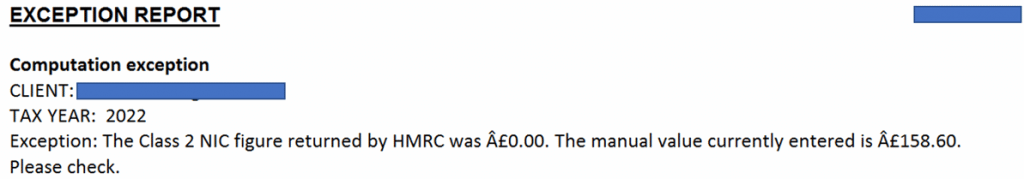

IRIS Personal Tax- Exception Class 2 NIC by HMRC was £0.00

Resolution

If you get this exception then it is only asking users to check if they are satisfied with the NIC calculation. This will not stop people submitting the return. If you believe the NIC2 value is valid then ignore and submit as it is.

If the NIC2 value should be removed or edited- Go to NIC Adjustments, Tick HMRC value (which should be blank) OR leave it on Manual and enter the new value (also tick Voluntary) and Ok to save.

Note: This exception warning cannot be switched off if HMRC data retrieval is switched on.

Why the Exception shows? If you create a sole trade/partnership business or a existing one and add in income – this will automatically fill in the NIC adjustment box with a value (eg £158.60 in 2022) and will not change (depending if income is sufficient enough this will then show on the Tax comp etc, if not sufficient then no NIC2 shows on tax comp). If you have HMRC data retrieval switched on, it will start checking the NIC adjustment box and not the tax comp, which causes the Exception to show which is why you can decide to override it.

For example: If you initially added in trade income but then reduced it to £0 later on- you will need to manually override the NIC2 box.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.