Personal Tax: Exception: Value returned by HMRC for marriage 'not applicable' status selected

Article ID

personal-tax-exception-value-returned-by-hmrc-for-marriage-not-applicable-status-selected

Article Name

Personal Tax: Exception: Value returned by HMRC for marriage 'not applicable' status selected

Created Date

24th August 2021

Product

Problem

IRIS Personal Tax- you get this exception when generating a Tax comp.

Resolution

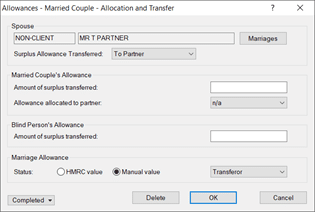

- Load the client who is transferring the allowance from (i.e partner giving away their allowance). If it’s a non client then go to step 6.

- Reliefs, Allowances, Married Couple, complete the ‘Marriages’ field.

- It must be set ‘To Partner’

- It must be set to ‘Transferor’ (if you cannot select -switch to Manual Value)

- OK to save. On this clients Tax return page TR5, the bottom field will be completed.

DO NOT TOUCH the ‘Married Couple’s Allowance’. This only applies to people born before April 1935. If you complete this accidently then it give a wrong calculation on the receiver of the allowance.

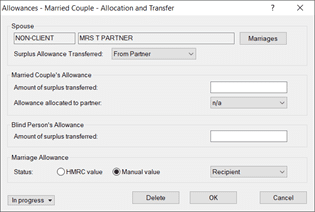

- Load the client who is receiving the allowance

- Reliefs, Allowances, Married Couple, complete the ‘Marriages’ field. IF it’s a non client partner then create a non client.

- It must be set ‘From Partner’

- It must be set to ‘Recipient’ (if you cannot select -switch to Manual Value)

- OK to save. NOTE: Tax return page TR5, the bottom field will not be completed as its only designed to show for the partner giving the allowance away.eg step 5.

- Check the tax comp – if the allowance is showing correctly then you can ignore this Exception as it will not block your submission to HMRC.

DO NOT TOUCH the ‘Married Couple’s Allowance’. This only applies to people born before April 1935. If you complete this accidently then it give a wrong calculation on the receiver of the allowance.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.