Personal Tax- HMRC Data Retrieval, how the data shows?

Article ID

personal-tax-hmrc-data-retrieval-how-the-data-shows

Article Name

Personal Tax- HMRC Data Retrieval, how the data shows?

Created Date

15th February 2022

Product

IRIS Personal Tax

Problem

Personal Tax- HMRC Data Retrieval, how the data shows? and new Property date warning in 2023/2024 + Error 3001 6221 INC12 and INC11

Resolution

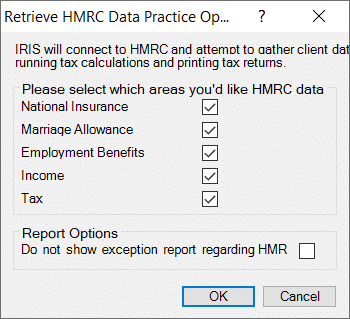

You must be on the latest IRIS version (Help and About) and check here: Setup/ Retrieve HMRC data practice options, the top five boxes must be all ticked.

How to setup your HMRC link: https://www.iris.co.uk/support/knowledgebase/kb/personal-tax-hmrc-data-retrieval-error-not-working-no-data/

HMRC data retrieval is dependent on the HMRC server having your clients data ready and they have authorised your Agent credentials. It only provides data for ‘Employment’, ‘Employment benefits’ and ‘Other pensions’ (in 2021 ‘SEISS’ data for sole traders was added in) .

Error 3001 6221 INC12 and INC11 – Check every income entry if they are using HMRC values – change this to manual values (and make sure you have the correct entry in the manual box), The ‘INC’ values are the HMRC values and do not have a dedicated box on the SA100.

Employment income and tax data – Open your employment earnings entry and tick ‘HMRC value’

Employment benefit data – Open your employment benefit screen and at the very bottom right – ‘View Benefits summary’

Other Pension data – Open pensions and state benefits, Other pensions, and at the very bottom right – ‘View Pension and state Benefit summary’

SEISS data for sole traders – Open the sole trade period, at the bottom ‘Update HMRC values’ BUT this will only show the HMRC value, there is no option to switch to your own manual value.

Student loan deductions for sole traders: IRIS PT cannot overwrite this as it is automated calculation for full 12 months as there is nowhere on the Tax return to show for sole traders (Much like trying to manually adjust a student loan calc under Employment, it is restricted). Also there is not a box provided by the HMRC to enter student loan repaid for self employment. We suggest to make a note on the return SA100 (Reliefs/ misc/ additional info) and HMRC will readjust the tax calc when they get the return.

Note: State Pension data – This is still NOT available from HMRC, you will not get this data from HMRC (as of Dec 2022).

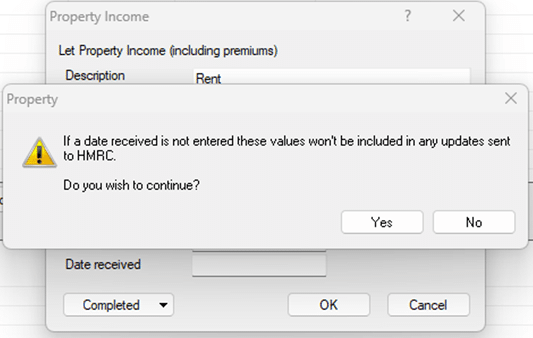

Property income HMRC update 2023/2024. If HMRC data retrieval is switched on and you enter property income BUT there is no date then this warning may appear. You can ignore this as it will not block online submissions.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.