Personal Tax- HMRC Exclusion ID127, 128, 129, 130, 131,136,140 Special ID39, 9 and 10

Article ID

personal-tax-hmrc-exclusion-id127-128-129-130-131-special-id39-9-and-10

Article Name

Personal Tax- HMRC Exclusion ID127, 128, 129, 130, 131,136,140 Special ID39, 9 and 10

Created Date

5th October 2021

Product

Problem

IRIS Personal Tax: When you generate you get a HMRC Exclusion ID127, 128, 129, 130, 131, 136, 140 Special ID39, 39, 9 and 10

Resolution

This list of HMRC Exclusion IDs are unique for each year. New ID codes not on the list below can be added on per year by HMRC.

If its shows as a HMRC Special ID then read this KB

These Exclusion ID may appear when you generate a tax return/tax comp. Read the message which explains what is happening and what to do next – some you have to submit by paper to HMRC, some have workarounds provided on the explanation.

What are HMRC Exclusion IDs? HMRC have made incorrect tax calculations which has affected IRIS PT as well. Until HMRC fix these issues from their side then IRIS PT cannot be corrected either and they have added in these Exclusion IDs to explain why.

When the Exclusion IDs appear?- HMRC may find a ID issue at any stage of a tax year and in the past. They will make a correction at any point so you may note a difference of a tax calculation from the start of the year and then checking later in the same year etc, this is because HMRC have applied corrections to fix these Exclusion IDs.

If i bypass this message and submit? You may get a 3001 6492 error or similar. This is because HMRC will not be able to process it online.

List of HMRC Exclusions IDs you may get in 2021 and 2022:

ID127

ID128

ID129

ID130

ID131

ID136

ID140

Special ID9 affects partnership

Special ID10 affects partnerships

Special ID39

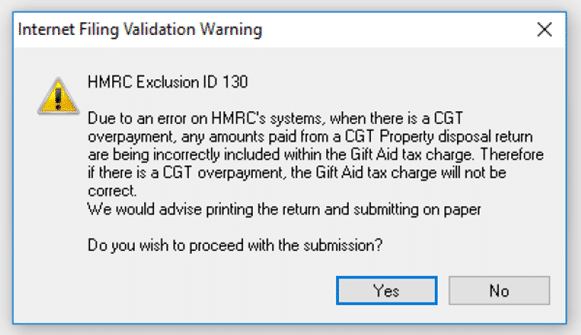

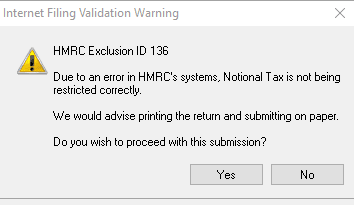

For example Exclusion ID130 and 136 looks like this:

If you need to submit by post when its closer to January deadline and past the paper submission deadline – attach this form https://www.gov.uk/government/publications/self-assessment-reasonable-excuse-for-not-filing-return-online

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.