Personal Tax- Making Tax Digital(MTD) and Quarterly Submissions 2024/25 onwards

Article ID

personal-tax-making-tax-digitalmtd-and-quarterly-submissions-2024-25-onwards

Article Name

Personal Tax- Making Tax Digital(MTD) and Quarterly Submissions 2024/25 onwards

Created Date

8th April 2025

Product

Problem

IRIS Personal Tax- Making Tax Digital(MTD) and Quarterly Submissions for 2024/25 onwards for Sole Trade/UK Property and Foreign Property.

Resolution

For the operation of HMRC MTD and Quarterly Submissions 2024/25 in Personal Tax, go through these steps in IRIS and HMRC: For advise email MTD@IRIS.co.uk. To register for the pilot go here

Making Tax Digital functionality has finally arrived, we have updated the Personal Tax product to enable you and your practice in preparation for the MTD pilot (April 2025). MTD functionality will run alongside the standard SA functionality and will simultaneously complete the clients SA return as well as giving the ability to complete in-year obligations where a client has been identified as MTD compliant. In this release of IRIS, we have delivered functionality which will enable you to complete the full end to end journey for individuals. The software will allow you to complete the in-year obligations associated with income sources which are required to be submitted quarterly, this will include sole trade, UK and foreign property Income. Additionally, the software facilitates the completion of the individual’s end-of-year financial position by submitting the final declaration to HMRC.

All MTD related submission will be channeled through the IRIS Digital Tax Hub, where the software will guide you through the MTD workflow, highlighting any outstanding tasks to simplify a complex MTD workflow. Register your interest today, if you would like more information on the MTD functionality or joining the pilot please contact us at MTD@IRIS.co.uk

a. IRIS version 25.1.0 or later version is required to launch the HMRC MTD system (starting in 2024/2025)- Help and About to check and then update. You must register to use MTD here go here and any queries MTD@IRIS.co.uk

b. You must register for HMRC MTD via the HMRC website, to create an ‘Agent Services Account’ (or ‘ASA’ login) and then register your clients onto MTD. This ‘ASA’ login allows the online interaction between your HMRC account and the IRIS PT. This ASA login is NOT the same login as your other HMRC ‘Agent credentials’ (which is used for BT/PT/TT) and is the same as the ASA login used for the VAT filer. If you already have the VAT filer with an ASA login then just register your clients via the HMRC site with that ASA login.

c. Affects specific Income types? This is only required for PT clients with three types of income: Self Employment(Sole trade), UK Property and Foreign Property. Any income which is not the three types listed above do not need quarterly submissions and just require end of year submission online of January. Note: If you have a client with multiple sole trade businesses then each one needs its own quarterly submission. So for example if you normally have 1 sole trade= a minimum of 4 quarterly submissions are required, if 3 sole trades= 4+4+4 totaling 12 quarterly submissions are required etc. There is no mass submit tool for all sole trades. HMRC require a separate submission PER sole trade, see step 5). It is also the cumulative total of the three required incomes to meet the thresholds, see step d.

d. Thresholds of income requiring submission? HMRC have decided to time stagger out the release of quarterly submissions based on the clients income. If the total cumulative Income falls within £1- £19,999 then HMRC do not require quarterly submissions and only require end of year submission as per old rules. Currently HMRC plan is income threshold £50K+ for April 2026, 30K-50K for April 2027, 20K-30K for April 2028(TBC).

e. Reporting types of the quarters? In specific reports it will list the per quarters values as a cumulative total which include any prior quarters. This is by HMRC design. For example Quarter 1 income is £1000, Q2 income is £500, Q3 is £0 and Q4 is £0. When you run certain reports which lists the 4 quarters it may a £1500 per quarter, rather then £1000 for 1st and £500 for 2nd. Only specific reports will use the cumulative totals.

f. How to input/import values? In 2024/2025 you may still manually enter Income/expenses etc into PT. However in 2025/26 users of PT can ONLY IMPORT the Income/expenses etc into PT from a CSV file. You cannot manually enter in the values anymore after a set date as the income etc boxes will be greyed out.

In Personal Tax, if you have completed steps A and B above.

1.Load PT and the client which you agreed to run quarterly returns for them and select the 2025 year. Go to Administration and Edit Tax Return dates. In the ‘Registered for MTD’ field, enter the date and tick the box. OK

2. A ‘HMRC popup’ may show when you run actions in PT, eg accessing/run reports etc. So login using your ASA login (This may also show on step5). It may also ask for security questions user Identity like passport etc about yourself as the PT user/accountant and not your client. These are HMRC requirements (not IRIS) which you must answer to proceed. If you have any issues with a question or cannot get to work then contact HMRC support and state you are trying to answer a security question but you get a issue etc. We recommend you take screenshots of the issue which will help on the call.

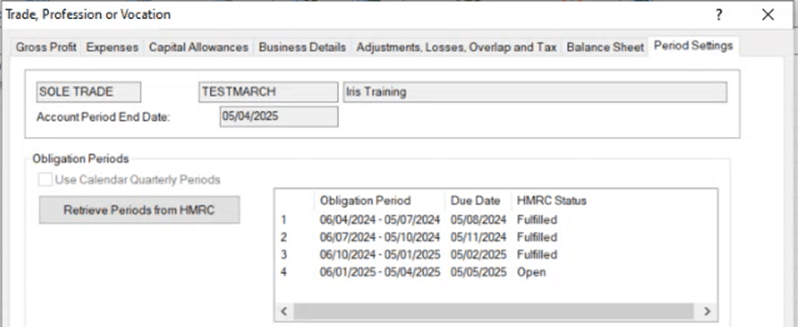

3. After logging in, on the STP Summary screen, open the relevant Sole trade period. Go to the ‘Period settings’ tab. Click – ‘Retrieve periods from HMRC’. It may request you login to HMRC here. If working and registered– the 4 Quarter Periods will show on screen and show which of the 4 periods have submitted or not

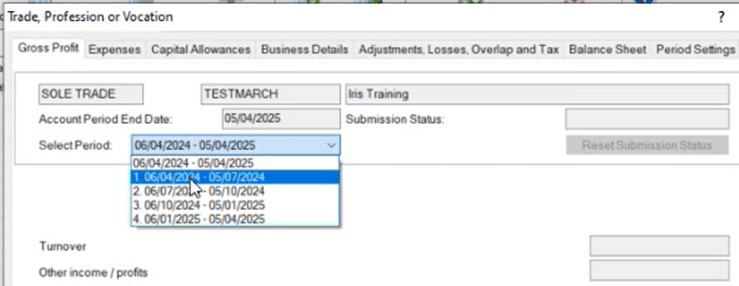

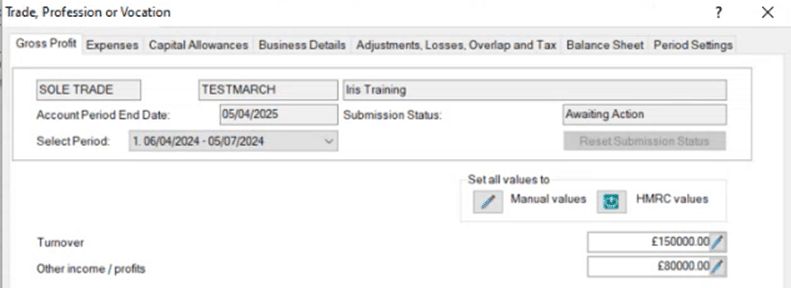

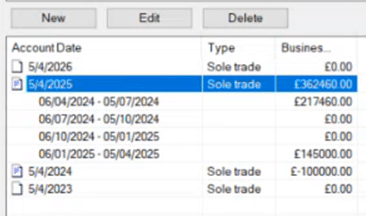

4. Go back to 1st tab ‘Gross profit’– at the top on the ‘Select Period’ field, this can now be pulled down to list all 4 quarters – select the relevant quarter and manually enter income/expenses per quarter and save. The summary screen will show the updated values

5. Back to the main PT screen, on the TOP RIGHT click the icon: ‘Digital Tax Hub’ and it will try and link this client to the HMRC system (it may ask you to login here as well, see step 2 above).

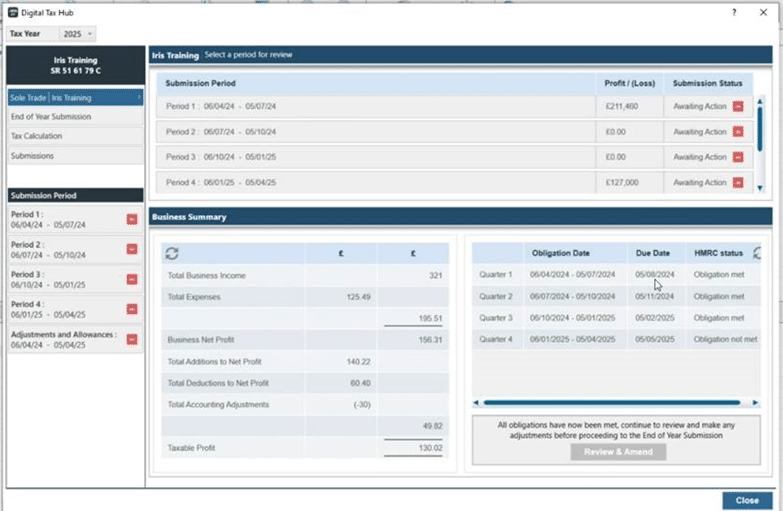

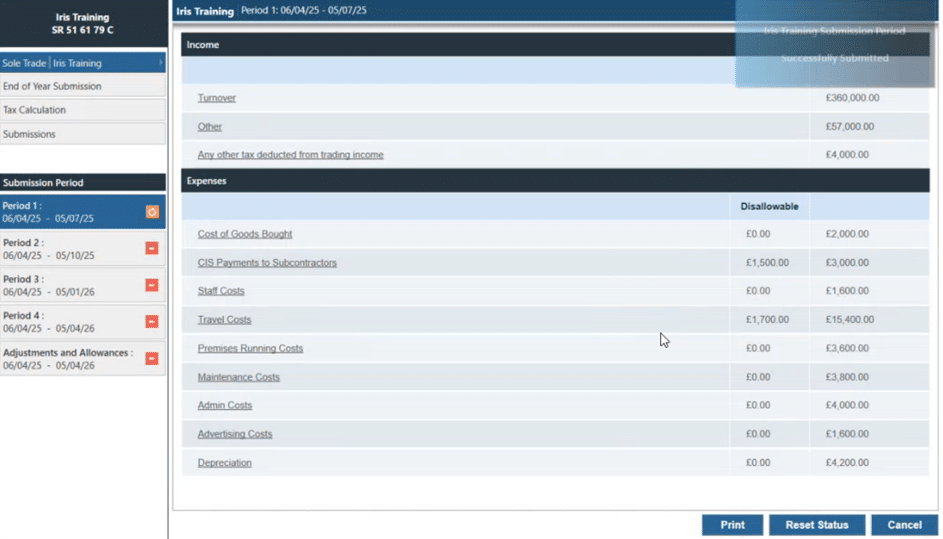

This example is for Sole Traders: on the TOP LEFT , place your cursor over the Sole Trade/’client name’ and it will list the sole trades and allows you to select the ‘Self employment’ business name, if multiple businesses then select the specific name. It will then load in the Quarterly Periods for this one trade. If no periods show then there is a issue either with your ASA login or a HMRC issue.

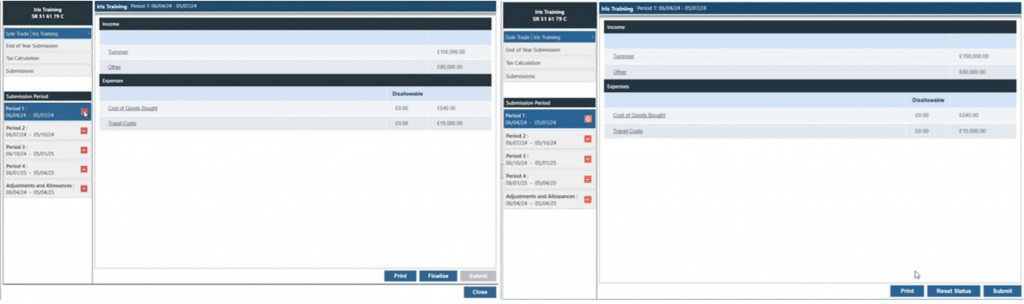

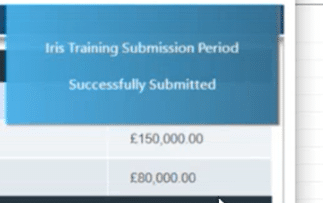

6. Click on the left side on Period 1 or Period 2 etc. Check if the values are correct or need to be edited. If correct then click ‘Finalise’ and ‘Submit’. A Pop up on the top right side will show as submitted – Note: there is no receipt/confirmation email from HMRC, there is a green tick against it and use the ‘Submissions’ tab on left side – to see records on what is sent or not and keeps track of it. Do this for all 4 quarters based on their deadlines.

7. HMRC allows you to send amended values for quarters (Within the HMRC timescales), correct the values and submit again and it will supersede the original submission. See step 11.

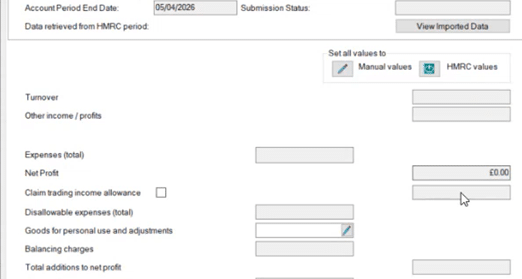

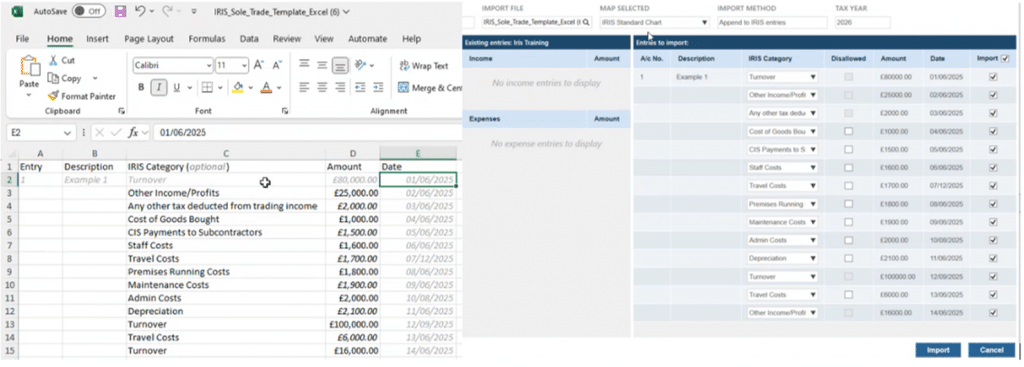

8. 2025/2026 changes. When the quarters is all completed in 2024/2025 then change year to 2025/2026, the income/expenses boxes are now blocked as users CANNOT manually enter values directly (Boxes are greyed out, see below). HMRC do not want users to enter values directly into PT like before, it must come from a EXCEL/CSV source.

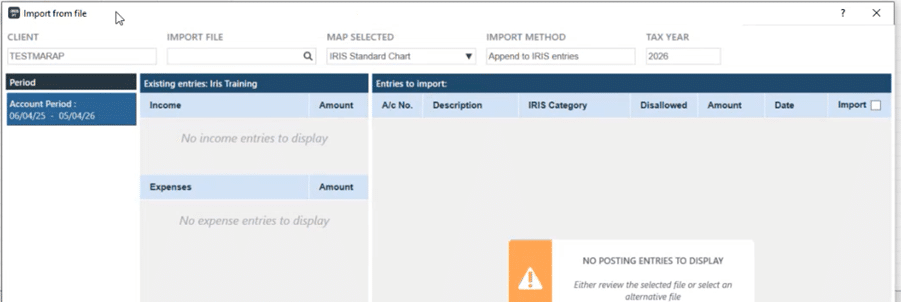

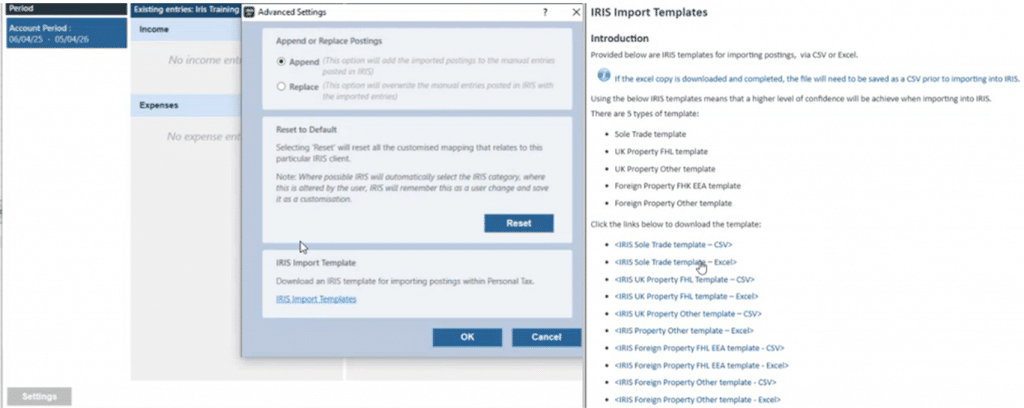

9. Close the Gross Profit screen and go to the very bottom of the screen – Users can only use a new ‘Import postings‘ button and ‘IMPORT FILE’ at the top tool to import a csv file. You can use set import csv/excel templates, click on SETTINGS on bottom left and IRIS import templates

10. Save the entries as a CSV, then import the data into PT. The values now show in a summary screen to allow a final check before importing (this also allows changing of a category). If correct now click IMPORT. The data will be transferred into PT for the relevant periods sole trade. On the TOP RIGHT click the icon: ‘Digital Tax Hub’ and it will now show the data showing into the relevant quarter to allow you to check, finalise and submit.

11. In MTD, when you have selected a period which you have already finalised/submitted. Click ‘Reset Status’, this will remove the cumulative adding up lock and allow imports again for this period (like for amendments)

12. UK Property and Foreign Property income rules? This uses the same rules as Sole trader. You can make manual entries as per normal into PT for the relevant quarter. Do note this manual entry can be restricted/blocked from a later 2025 IRIS version update (Date TBC) and would then require CSV imports. You do not need to make separate quarterly submissions PER property (Only Sole trader businesses require this)

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.