Personal Tax- Partnership shows up as Sole trader OR you only deal with one of the Partners

Article ID

personal-tax-partnership-shows-up-as-sole-trader-or-you-only-deal-with-one-of-the-partners

Article Name

Personal Tax- Partnership shows up as Sole trader OR you only deal with one of the Partners

Created Date

21st September 2021

Product

Problem

Personal Tax- A Partnership business shows up as Sole trader on bottom half OR you only deal with one of the Partners

Resolution

To trigger the partnership pages you need two or more partners within the Partnership. If you only create one partner within the business then PT will automatically treat it as a sole trader.

BUT you only deal with one of the partners? (the rest are not your clients). If correct then just create a fake partner.

- Load client and relevant period

- TPV/ STP

- On the top half – click Edit

- Related and then involvements

- There should be one active partner listed here under the Partner tab – click New

- Next to Partner click the magnifying glass

- On the top right – click the + PLUS symbol (or new button if on old screens)

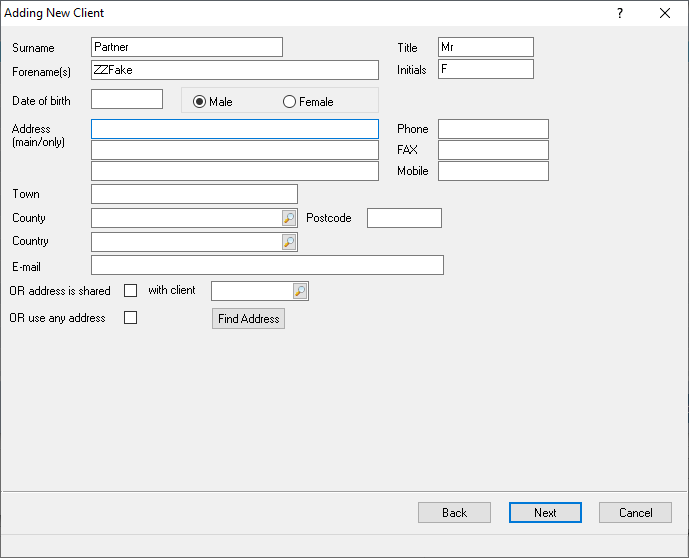

- Create a new client – Next

- Person and Next

- Give a fake name eg ‘ZZFakepartner’ and Next

- When it asks for a unique ID – name it ‘ZZFakepartner’ (Why the ZZ: its because this will appear at the very bottom of your client lists and wont clutter up your real clients)

- Save and give it a ‘From Date’

- Once saved correctly – the Sole trader will automatically change to Partnership

- Remember to keep using the ‘ZZFakepartner’ for any future partnerships.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.