Personal Tax- Pension Contribution total is higher on Tax comp etc 12.5% increase

Article ID

personal-tax-pension-contribution-total-is-higher-on-tax-comp-etc-12-5-increase

Article Name

Personal Tax- Pension Contribution total is higher on Tax comp etc 12.5% increase

Created Date

10th January 2024

Product

IRIS Personal Tax

Problem

IRIS Personal Tax- Pension Contribution total is higher on Tax comp etc 12.5% increase

Resolution

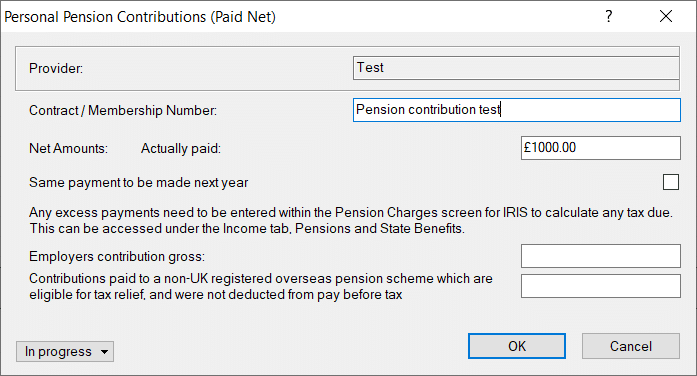

For example you enter £1000 Pension Contribution but on the Schedules and Tax comp – it appears as £1250 which is a 12.5% increase, why?

Pension Contribution Net Amounts, actually paid – enter the TOTAL amount actually contributed in the fiscal year, the allowable amount may be less than this if the client has insufficient net relevant earnings, enter the allowable amount using the maximum contributions screen. Do NOT deduct any amounts being carried back to a previous year.”

This “Net amount” refers to the actual amount paid to the pension provider. The relief is given at source. So the £1250 is gross and % relief = £250 leaving net £1,000. This is a typical pension policy as Retirement annuity contracts do not exist any longer for new policies so pension payments are made net of basic rate tax relief not gross. If the client’s income is taxable at higher rate the gross equivalent pension contributions for the year are added to extend the basic rate bane for that individual.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.