Personal Tax- Period Reform 2024: Spread Transition profit treated as arising FPS16.1 and 3001 8625 FPS16.1

Article ID

personal-tax-period-reform-2024-spread-transition-profit-treated-as-arising-fps16-1-and-3001-8625-fps16-1

Article Name

Personal Tax- Period Reform 2024: Spread Transition profit treated as arising FPS16.1 and 3001 8625 FPS16.1

Created Date

26th September 2024

Product

Problem

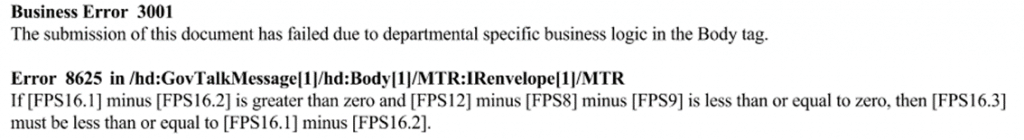

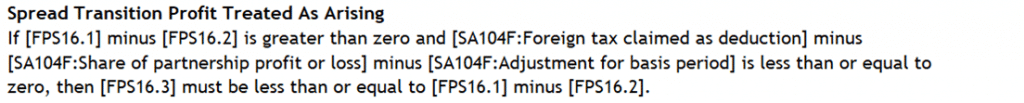

IRIS Personal Tax- Period Reform 2024: Spread Transition profit treated as arising FPS16.1 and 3001 8625 FPS16.1

Resolution

- Load Client in PT and the 2024 year (this normally affects the 2024 year)

- Check all trades and ensure they have the next 2025 period entered as well. eg you may have only a 05/0/2024 period entry, so enter a 05/04/2025 period as if your getting ready for the next year

- Regenerate and submit

- If you get the same errors, go to all the trades and check the Transitional Period summary screen: Has the ‘Step 5 apportioned transition profit’ been overridden , eg you want to tax all of it in the 2024 year or changed the value?

- If yes – remove the override tick to all the trades, then regenerate the SA100 again , if no errors then dont submit so go back to all the trades and go to the Transitional Period summary screen: go to the ‘Step 5 apportioned transition profit’ and tick override and type in the value you want to be taxed on. Regenerate the SA100 again.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.