Personal Tax- Period Reform: Spread Transition Profit arising, Difference FSE73.1 minus FSE73.2 etc and 3001 8611

Article ID

personal-tax-period-reform-spread-transition-profit-arising-difference-fse73-1-minus-fse73-2-etc-and-3001-8611

Article Name

Personal Tax- Period Reform: Spread Transition Profit arising, Difference FSE73.1 minus FSE73.2 etc and 3001 8611

Created Date

30th December 2024

Product

Problem

Personal Tax- Period Reform: Spread Transition Profit arising, Difference FSE73.1 minus FSE73.2 etc and 3001 8611

Resolution

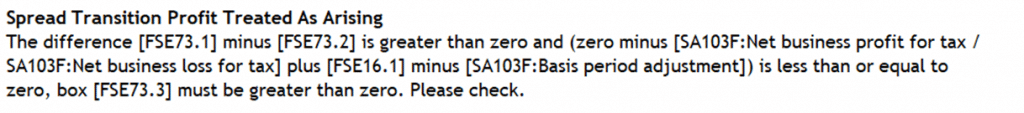

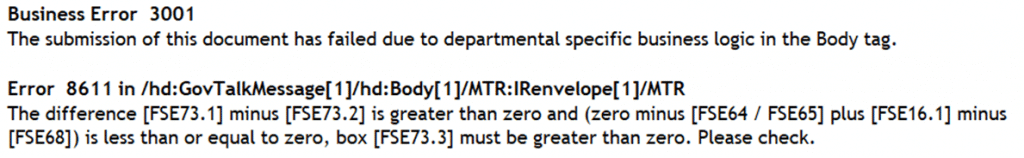

When you generate you get this Spread Transition Profit arising validation and if you ignore and submit you get a 3001 8611 error. You may have made a invalid entry for the trade which is not permitted by HMRC or there is a confirmed DEFECT and fixed with the 24.3.2 IRIS version.

Note: There is another similar error but has error 3001 8614

- Load the client and the 2024 year

- In the TPV section, open the 2024 period for the trade

- At the bottom click the Magnifying glass for the ‘Transitional Period Profits Taxable’

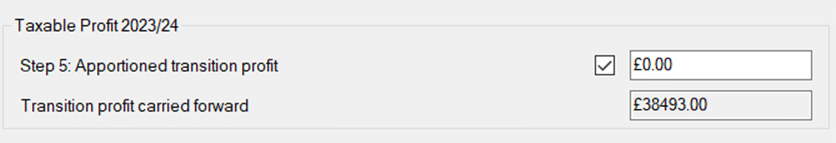

- Check Step 5: Apportioned Transition Profit- has the override box been ticked AND the value in there is edited or Nothing/£0.00 shows (see image below), if its ticked then go to the next step.

- UNTICK the override box and allow PT to auto calculate the profit spread (It must not show a Null/£0.00 value).

- Now regenerate the tax return and you should not get the Spread Transition Profit arising validation

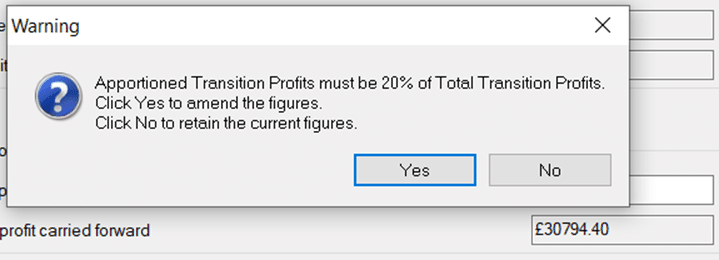

- If you must edit the Step 5 box value then tick the override and enter a valid entry- it will warn you if the value is not permitted as it must be 20% of the total profits.

- If there is a valid entry in Step 5 box but it has an auto calculated value less then £1.00, then use this workaround: Tick the override tick box and change the value so it uses ALL of the Transitional Profit (and shows 0.00 in the Transition Profit carried forward). This will then show on the Tax comp as taxing the entire Transitional Profit and not spread it out. If don’t want to tax all of it in 2024 then change the entry in Step 5 so it shows a minimum value of £1 (or a higher value) and the rest will be carried forward.

- IF none of the workarounds above work or are relevant (eg there are no transitional profits even being calculated on Step 5 and you haven’t ticked the override) then please first update to IRIS version 24.3.2 and check again.

- If you still have this issue whilst on 24.3.2 then our IRIS Development Team is investigating this but there is no confirmed release date yet.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.