Personal Tax- Period Reform: Spread Transition Profit as Arising, Difference FPS16.1 minus FPS16.2 must be greater than zero

Article ID

personal-tax-period-reform-spread-transition-profit-as-arising-difference-fps16-1-minus-fps16-2-must-be-greater-than-zero

Article Name

Personal Tax- Period Reform: Spread Transition Profit as Arising, Difference FPS16.1 minus FPS16.2 must be greater than zero

Created Date

12th December 2024

Product

Problem

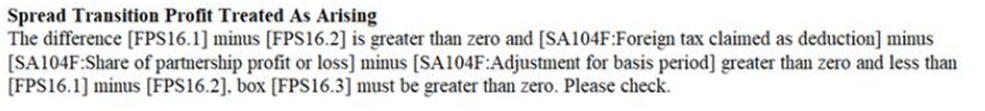

IRIS Personal Tax- Period Reform: Spread Transition Profit as Arising, Difference FPS16.1 minus FPS16.2 must be greater than zero

Resolution

- You get this warning above when generating a Tax Return as this is because PT is missing date data

- Load the Client in PT and the relevant year

- If the Partnership has no Start/Commence date then please do this:

- Load the TPV section, On bottom half of screen click NEW

- Click ‘Add’ and enter in the prior missing period dates (try 1 prior date entry first, if that fails then add a 2nd further older period etc). This applies even if the partnership didnt run at that time.

- Regenerate Tax return

- If the Partnership does have a Start/Commence date then please review and edit the date OR add in the prior missing period dates

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.