Personal Tax- Property loss (capital allowance) use against Other Income + Offset against Total income

Article ID

personal-tax-property-loss-capital-allowance-use-against-other-income

Article Name

Personal Tax- Property loss (capital allowance) use against Other Income + Offset against Total income

Created Date

18th January 2023

Product

Problem

IRIS Personal Tax- Property loss (capital allowance) and need to use against Other income + Losses Offset against Total income

Resolution

Property losses cannot be offset against other income unless the losses have been created by capital allowances.

Property losses can only be offset against other income PRE 2012. If the losses are not as a result of capital allowances or from a FHL the system will ignore the request and carry forward the losses to the following year.

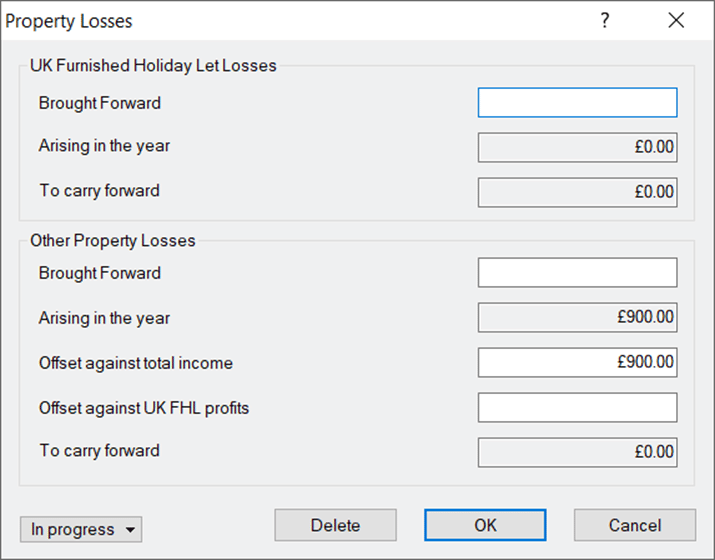

If you have capital allowances enter the loss value here under the UK Property Losses: Offset against total income OR Offset against UK FHL profits

Losses Offset against Total income (Allowance value changing on Tax comp)

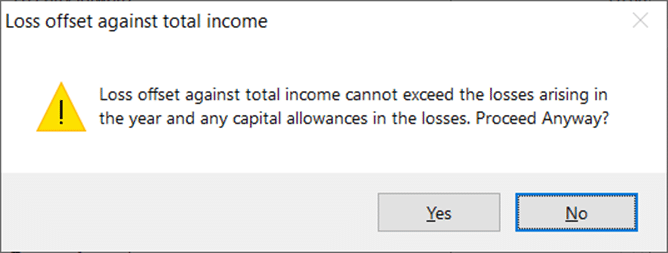

PT will warn you (image below) if you enter a value here IF it exceeds the losses (Note that Other Brought Forward Losses are automatically used and appears on the Tax comp as relief) and the value entered will also be added onto allowances of the Tax comp (at the very bottom table)

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.