Personal Tax- SA108 Gains qualifying for Business Asset disposal relief (BADR) is valid if this does not exceeds £1,000,000

Article ID

personal-tax-sa108-gains-qualifying-for-business-asset-disposal-relief-is-valid-if-this-does-not-exceeds-1000000

Article Name

Personal Tax- SA108 Gains qualifying for Business Asset disposal relief (BADR) is valid if this does not exceeds £1,000,000

Created Date

9th January 2023

Product

Problem

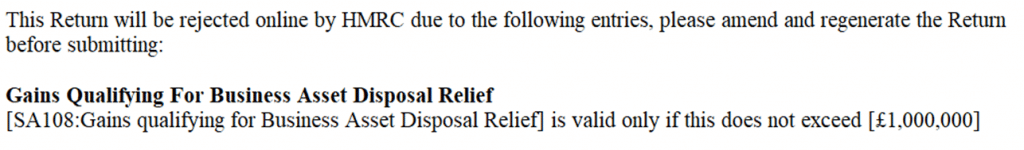

IRIS Personal Tax- SA108 Gains qualifying for Business Asset disposal relief is valid if this does not exceeds £1,000,000. Box 50 ad 50.1 CG3 Entrepreneurs’ Relief and BADR

Resolution

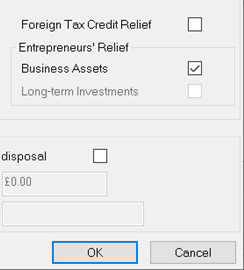

Check all your capital disposals (Assets and Share and OCG) and check if it the Entrepreneurs’ Relief tick box was claimed and check if the gain(s) exceeds £1 million allowance, note down these disposals. This normally affects 1 single gain entry which is over £1 million.

Business Asset Disposal Relief was known as Entrepreneurs’ Relief before 6 April 2020. BADR/ER provides a beneficial 10% Capital Gain Tax rate on the first £1 million of eligible gains per individual (on a lifetime basis). The gain itself may exceed the £1 million which is causing the error. Read the HMRC rule: https://www.gov.uk/government/publications/entrepreneurs-relief-hs275-self-assessment-helpsheet/hs275-business-asset-disposal-relief-2021

To fix: The gain value will populate CG3 Box 50 and will exceed the £1 million limit causing the error.

You will need to split the one entry into 2 separate gains: Create the 1st gain claiming the maximum £1 million and ticked BADR. Then create 2nd gain which is the rest of gain amount and not ticked BADR (as you cannot claim more than £1 million). Add an additional note to explain its actually from 1 asset and not 2 assets. After you make the 2 gain entries, now check Box 50 if its showing more then the permitted £1 million (Like £1,000,001). If it is then manually reduce the BADR claim amount and adjust the 2nd gain entry.

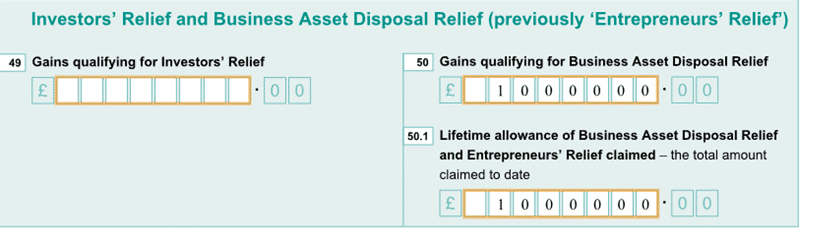

CG3 Box 50 HMRC rules states that ‘BADR’ is given on the amount before Losses and AEA and NOT the Net total capital gains in the year

CG3 Box 50.1 will show the Box 50 disposal value if below the allowance limit (up to the £1 million limit).

This is what CG3 should look like if you claim up to the Max BADR relief limit on 50 and 50.1. (the value in 50 must not exceed 50.1, if it exceeds 50.1 then read the fix above)

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.