Personal Tax- SA109 Unremitted income and gains under £2000 OR error 3001 8573 NRD29 23.1 and 23.2 etc

Article ID

personal-tax-sa109-unremitted-income-and-gains-under-2000-or-error-3001-8573-nrd29-23-1-and-23-2-etc

Article Name

Personal Tax- SA109 Unremitted income and gains under £2000 OR error 3001 8573 NRD29 23.1 and 23.2 etc

Created Date

24th January 2023

Product

Problem

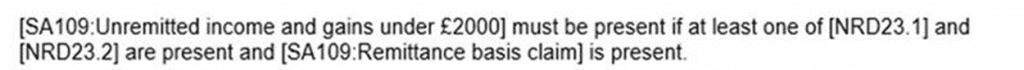

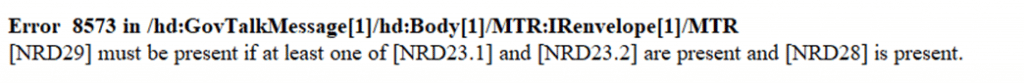

IRIS Personal Tax- SA109 Unremitted income and gains under £2000 OR error 3001 8573 NRD29 23.1 and 23.2 etc

Resolution

1.Load the client in PT and correct year.

2. Reliefs, Misc, Resident Questionnaire

3. Remittance Basis TAB , and the Claiming remittance basis box has been claimed.

4. You need to tick ‘Unremitted income and capital gains is less then £2000’. This may affect the Tax due calculation and this follows HMRC rules in PT. If you need to check then you need to contact HRMC support.

If you need to check if Remittance charge claim is needed for your client: https://www.iris.co.uk/support/knowledgebase/kb/personal-tax-residence-question-remittance-basis-charge-claim/

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.