Personal Tax- Seafarers' Deductions

Article ID

personal-tax-seafarers-deductions

Article Name

Personal Tax- Seafarers' Deductions

Created Date

4th October 2022

Product

Problem

IRIS Personal Tax- Seafarers' Deductions

Resolution

If you are on IRIS version 22.2.0 (from 2022) then it is under Employment, Earnings and open the company and entry at very bottom

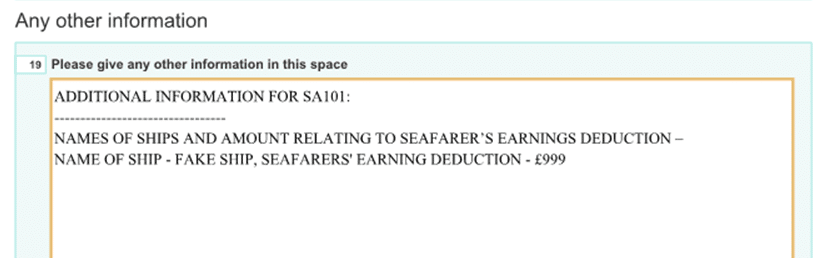

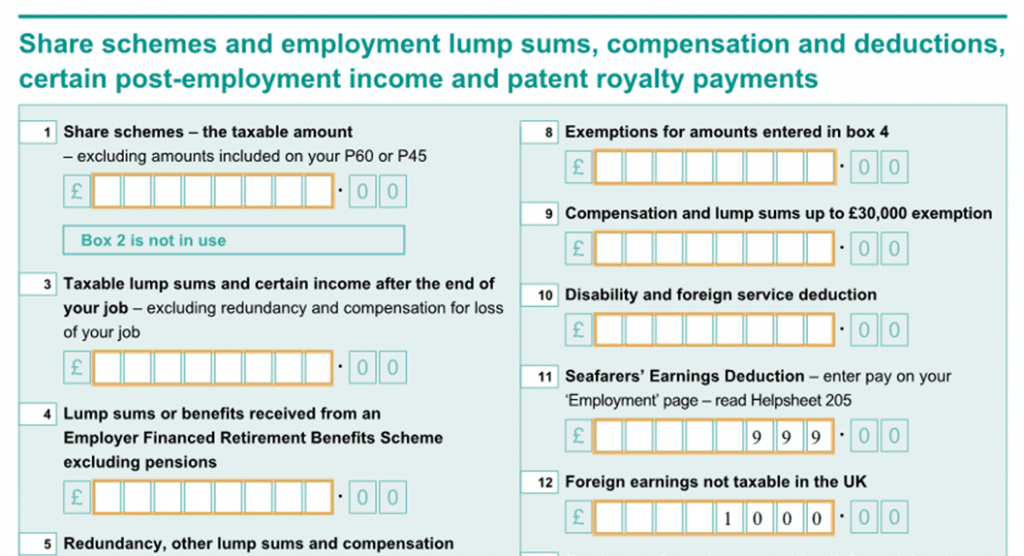

If you are on IRIS version 22.3.0 (October 2022) then it is under Employment, and it now has its own field ‘Seafarers’ (and not under the company employment). There are mandatory fields which now need to be populated. This new feature only appears if on 22.3.0 and you are working from 2022 and onwards. This will appear on TR7 box 19 as a note and AI2 Box 11/12.

Note: If the Employment earnings are lower/or zero than the foreign earnings not taxable in the UK – then the foreign earnings not taxable value must not be higher or the seafarers value will not be filled in on the tax return box 19 and 11 with values (If too high then the value will be omitted from the two boxes).

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.