Personal Tax- Trade Income missing on Comp/SA100 on 31/03/2025 and 360/365 days with incorrect Tax Comp/SA100 calculation

Article ID

personal-tax-trade-income-missing-on-comp-sa100-when-accounting-period-is-31st-of-march-2025-360-365-and-incorrect-tax-comp

Article Name

Personal Tax- Trade Income missing on Comp/SA100 on 31/03/2025 and 360/365 days with incorrect Tax Comp/SA100 calculation

Created Date

9th April 2025

Product

Problem

IRIS Personal Tax- Trade Income missing on Comp/SA100 when accounting period is 31st of March 2025 and 360/365 days days with incorrect Tax Comp/SA100 calculation

Resolution

There are TWO DEFECTS with IRIS version 25.1.0 in 2025. We are planning to release a fix in the week commencing 12th MAY 2025 Service Pack release (subject to change).

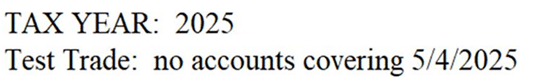

Missing Trade Income: This is a defect with Self-employment and partnership income is not appearing on the computations and the tax return when the accounting period is the 31st of March 2025. This also causes an exception report that states no accounting period covers the year end. Workaround: Enter the next accounting period (Add in the next ‘2026’ period, for example 31/03/26) , once this date has been entered the figures will now show on the computations and the tax return.

Trade computation showing 360/365 days and incorrect calc on Tax comp/SA100? This is a visual issue on the trade computation where it shows as 360/365, the calculation has included the 5 days of profit / loss in the basis period but the trade computation profit calculation is correct. However the tax computation AND/OR the tax return are not correct and is then showing the wrong calculation for class 4 NIC which is the reason that you may get a 3001 6492 when submitting. Unfortunately, there is no work around and the return cannot be filed till the MAY Service pack has been released.

We sincerely apologise for the inconvenience.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.