Personal Tax- Trade loss to offset income but not giving 100% relief on Tax comp (Capped £50,000)

Article ID

personal-tax-trade-loss-to-offset-income-but-not-giving-100-relief-on-tax-comp-its-being-capped

Article Name

Personal Tax- Trade loss to offset income but not giving 100% relief on Tax comp (Capped £50,000)

Created Date

27th January 2023

Product

Problem

IRIS Personal Tax- Trade loss to offset but not giving full 100% relief on Tax comp (Its being capped at £50,000)

Resolution

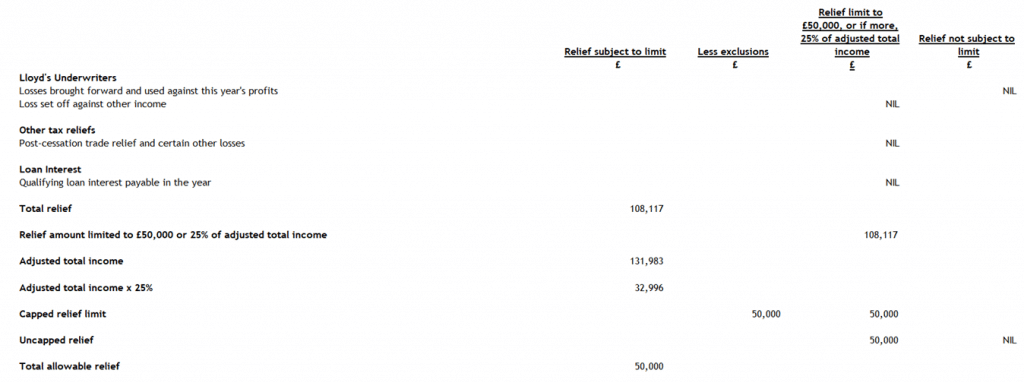

For Example: In the current year you have £100,000 Sole trade or Partnership loss and you want to use this offset against other income. So you expect a £100,000 Income Tax relief to show on the Tax comp, but it instead shows a less relief value (Eg Up to £50,000).

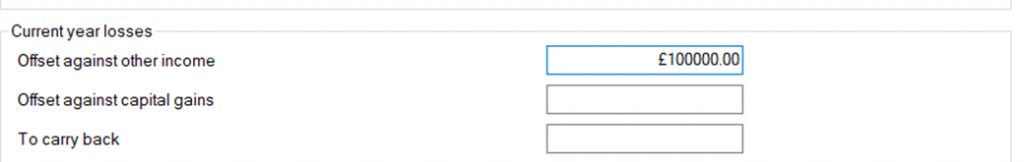

You open the trade, Adjustment losses, overlap and tax Tab. Enter the £100,000 offset against other income.

Now run the report – ‘Capped allowable trading losses and reliefs report’. PT has to cap the relief based on this HMRC rule and show the updated permitted relief on the Tax comp. This ruling and capping cannot be overridden.

For example – this Trade has reliefs totaling £108117 but it will be capped at £50,000.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.