Personal Tax- Period Reform: Transitional Profits Calculating not at the expected 20%/40% tax rate, why?

Article ID

personal-tax-transitional-profits-calculating-not-at-the-expected-20-tax-rate-why

Article Name

Personal Tax- Period Reform: Transitional Profits Calculating not at the expected 20%/40% tax rate, why?

Created Date

8th November 2024

Problem

Personal Tax- Transitional Profits Calculating not at the expected 20% or 40% tax rate, why?

Resolution

The IRIS Personal Tax calculation is correct as confirmed by the IRIS Development Team.

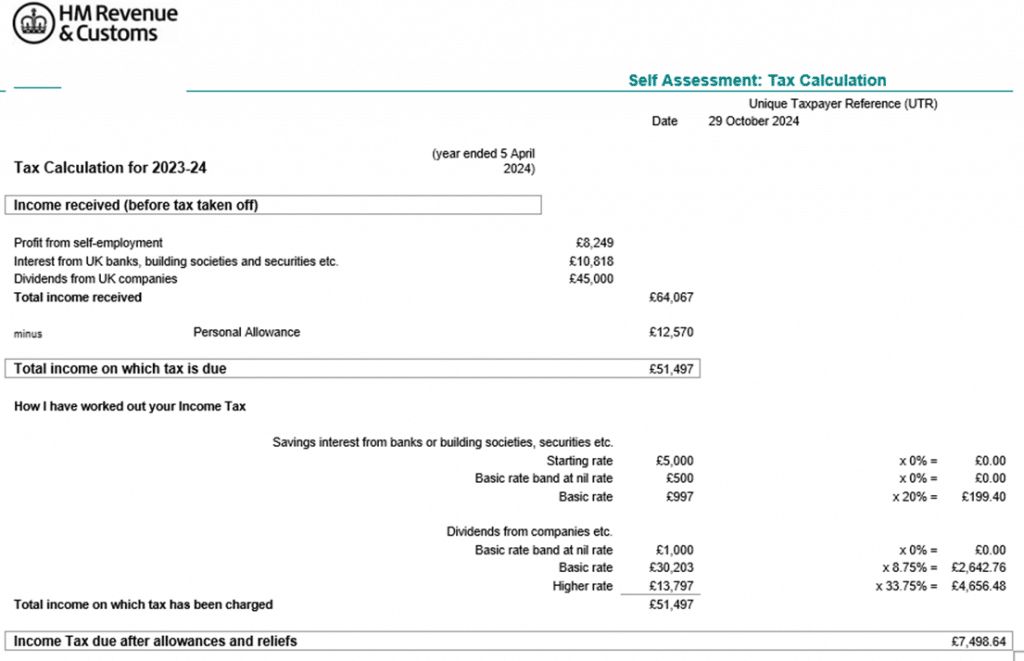

HMRC calculates the ‘tax due on transition profits‘ (at the bottom of the Tax Comp) as the difference between the Tax liability both with and then without those transition profits, it is not charged at a specific rate. This can show differently rather then an expected set % rate (like for example 8.75%, 20%, 24.2%, 40%, 43%, 45%, 49.8%, 55% or higher % etc).

This does sometimes give the illusion of the transition profit being taxed at a lower or higher rate. This is most experienced where there is an interaction with the savings and dividend allowances and the savings rate band, as in this case.

For Example: The easiest way to demonstrate this is, remove the transition part profit value and then add it to the standard part profit, so that the correct amount of 8,249 (7,277 + 972) profit is still being taxed and note that the result is the same, being tax due of £7,498.64. (See image below)

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.