Personal Tax- Using Client Paper Checklists and Queries

Article ID

personal-tax-using-client-paper-checklists-and-queries

Article Name

Personal Tax- Using Client Paper Checklists and Queries

Created Date

18th April 2023

Product

Problem

IRIS Personal Tax- Using Client Paper Checklists and Queries

Resolution

If you are on IRIS 24.1.0.576 version– When you load the checklist for a client for 2024 but it hangs and automatically closes PT, this has been reported as a known issue and our Development team has released a fix – please update to IRIS version 24.1.0.578 and rerun the checklist.

There are two types of checklist in IRIS Personal Tax: Paper checklist and E-checklist

E-checklist is built to work within IRIS Openspace and can import the clients data back into PT with minimum manual keying in data. Do read the KB: https://www.iris.co.uk/support/knowledgebase/kb/personal-tax-using-client-e-checklists-and-queries/

Paper checklist can be used outside of Openspace by either letters and direct emails to clients. Follow the steps below:

1. Load a PT client and select a year NOTE: It only picks up the clients PT data from the prior year eg 2022 data when you are generating in the 2023 year.

2. Admin and Paper checklist

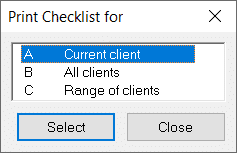

3. Choose: Current client OR All clients OR Range of clients.

NOTE: If you select ‘All clients’ or ‘Range of Clients’ and save it as WORD or PDF, all the clients will be created in one single WORD/PDF file (it will be several pages long). You will need to manually copy/cut the PDF/WORD into separate PDFs/WORD files for each client. Unless you run the option ‘Current Client’ per client.

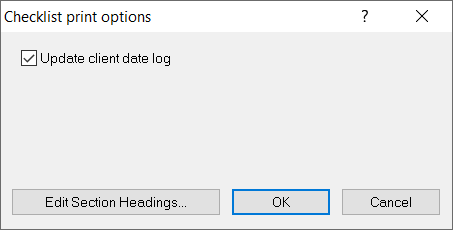

4. If you want to edit the questions content – click ‘Edit section headings’. Then click OK

5. Report output screen: Choose how you want it to be saved eg PDF or print and where it should be saved (click Details and Browse and select the area on your pc/server you want it saved).

NOTE: If you do select PDF, the option to Upload to Openspace will now be available and you can send this PDF to the clients OS account (rather then using the E-checklist system).

6. Now check the checklist, if correct then you will decide how the client receives it (if data is incorrect, either go back to prior year and manually edit PT entries and run a new checklist OR if saved in word, manually correct it). You will need to manage the sending of the files outside of PT (handing it to them, arranging email and attach the PDF/WORD, paper letter etc).

7. When client comes back with the updated checklist – you need to manually key that information back into PT.

On Section C it still shows the partner name even when separated from them, why? This is because of ‘Marriage allowance’ as it is still available even if separated from spouse/civil partner- so it needs to show the details on the paper checklist.

On Section E RELIEFS it is still showing ‘Elected to carry back’ column which is no longer used. This is with our Development team to correct this in a future IRIS update (date TBC). If you want to correct it, then save as a WORD file and remove this column before sending to your client.

Can we create a blank checklist with all the income titles etc? There isn’t a blank template with all the income titles etc (when they have no prior data in PT). However you can create a test client in PT – fill in fake income data on all fields – create the paper checklist and save as word – remove all income value and use that a manual word template for brand new clients to PT.

Checklist report crashing when using option ‘All clients’ or for certain clients? First ensure you update to the latest IRIS version first (there was a known issue in 2024). Once version is up to date but same issue: There can be a data issue with one or more clients causing the crashing (data entry, marriage setup etc), use the ‘range of clients’ tool instead of all clients to avoid certain clients. If it affects one specific client – load that client in PT and check all entries in the prior year, and go to Edit/mark data entry complete/ and ensure every section is completed, then run a final tax comp, Change to next year, edit, bring forward data, run tax comp. Now run a paper checklist.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.