Personal Tax/VAT Filer- You have chosen to stop the HMRC data collection

Article ID

personal-tax-vat-filer-you-have-chosen-to-stop-the-hmrc-data-collection

Article Name

Personal Tax/VAT Filer- You have chosen to stop the HMRC data collection

Created Date

4th November 2022

Product

Problem

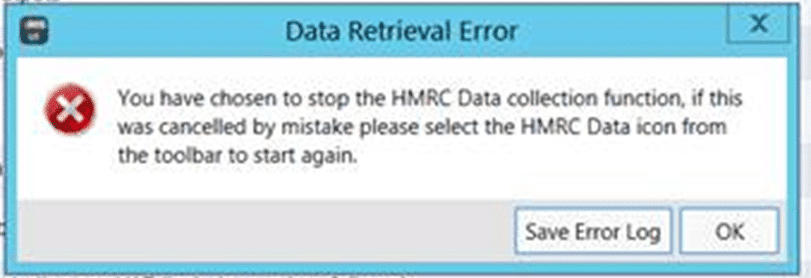

IRIS Personal Tax/VAT Filer- You have chosen to stop the HMRC data collection function

Resolution

The PT HMRC data retrieval and VAT Filer needs your Agent or ASA Credentials recognised by them to allow the clients data to show in PT/VAT.

1.Go to Help and about and ensure you are on the latest IRIS version – you can check on Help and ‘Check for downloads‘

2. Check your IRIS license is up to date for PT and VAT. If they have expired then you need to renewal them with the IRIS License team

3. If you get this in PT- reset your agent credentials and log back – read this link: https://www.iris.co.uk/support/knowledgebase/kb/personal-tax-hmrc-data-retrieval-error-not-working-no-data/

4. If you get this in VAT filer- reset your agent credentials and log back in – read this link: https://www.iris.co.uk/support/knowledgebase/kb/vat-filer-internal-server-error-or-date-periods-vanish-or-agent-client-not-authorised/ and remember you also have to link your HMRC ASA login and clients MTD on the HMRC gateway: https://www.iris.co.uk/support/knowledgebase/kb/vat-authorise-the-software-to-interact-with-hmrc/. If this is not done correctly you will not have any data showing on the VAT or you get errors.

5. If you have several PCs with IRIS PT/VAT on it, login to their pcs and see if you get the same warning – if you do, then it reaffirms its linked to your agent login details. if you dont and it works fine then its a issue on that one affected PC.

If you get a new warning Allow your software to interact with HMRC every day/week etc- read this link: https://www.iris.co.uk/support/knowledgebase/kb/personal-tax-hmrc-data-retrieval-keeps-asking-me-to-login-again-after-days-week/

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.