Personal/Trust Tax: Property Capital gain, 2024/25 18/24% rate

Article ID

personal-trust-tax-property-capital-gain-2024-25-18-24-rate

Article Name

Personal/Trust Tax: Property Capital gain, 2024/25 18/24% rate

Created Date

8th April 2025

Product

Problem

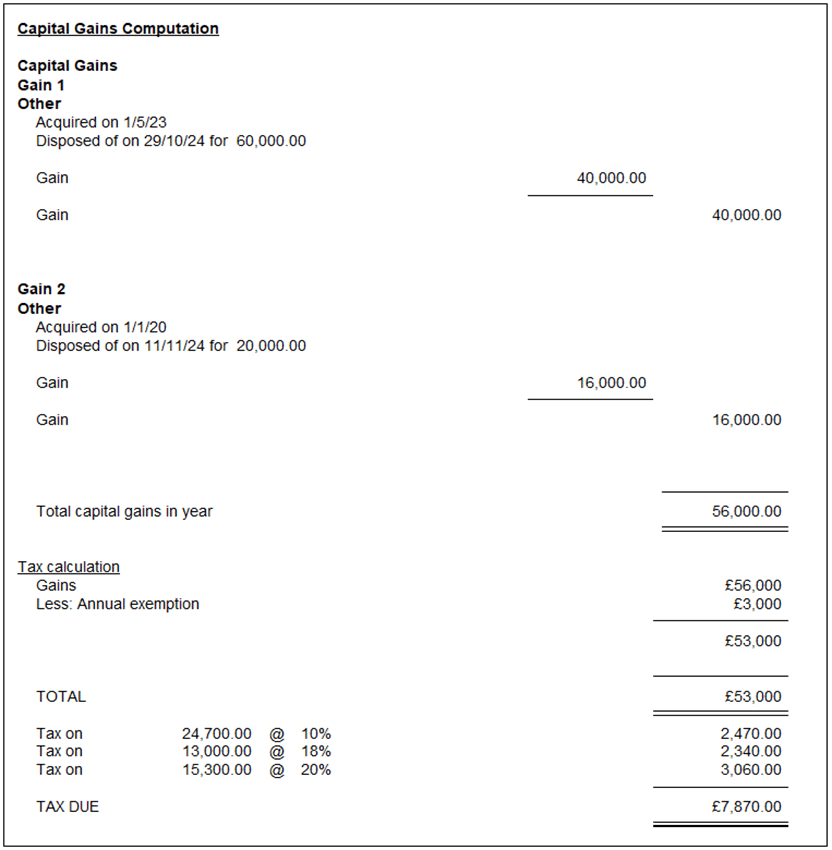

IRIS Personal/Trust Tax: Property Capital gain 2024/25 18/24% rate - show an 'adjustment' in box 51/5.17.B/5.37A in PT and Trust tax

Resolution

The new HMRC 18/24% rates is released with version 25.1.0 in April 2025. IRIS Personal Tax and Trust Tax calculates the correct capital gains tax position for 2024/25 considering the change in capital gains tax rates from the Budget 30/10/2024.

Capital Gains Tax Rate changes

Gains on disposals up to and including 29/10/2024:

lower rate = 10%

upper rate = 20%

Gains on disposals on and after 30/10/2024:

lower rate =18%

upper rate = 24%

However, HMRC have not made the same change to their own calculation that will be done when the tax return is submitted online. Their calculation is run based on the application of the pre-budget rates of 10% and 20% for various asset types. An adjustment is then calculated in respect of those gains made on or after 30/10/2024 to correctly reflect the application of the correct rates of capital gains of 18% and 24% (where applicable).

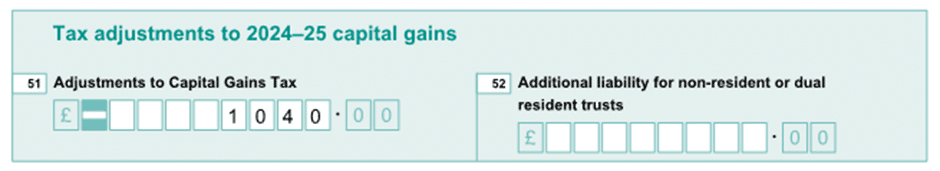

IRIS calculates the appropriate ‘adjustment’ as required and is shown in box 51 on the SA108 and boxes 5.17B and 5.37A on the Trust Capital Gains pages. Example for an individual SA100

The ‘adjustment‘ is automatically calculated and shown in Box 51. In this example the adjustment Is £13,000 x 8% = £1,040 representing the increased rate of tax applied to £13,000 of the total gains.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.