ShareFisherman NIC Class 2 calculation input figure different to Tax computation and SA110

Article ID

sharefisherman-nic-class-2-calculation-input-figure-different-to-tax-computation-and-sa110

Article Name

ShareFisherman NIC Class 2 calculation input figure different to Tax computation and SA110

Created Date

15th April 2020

Product

IRIS Personal Tax

Problem

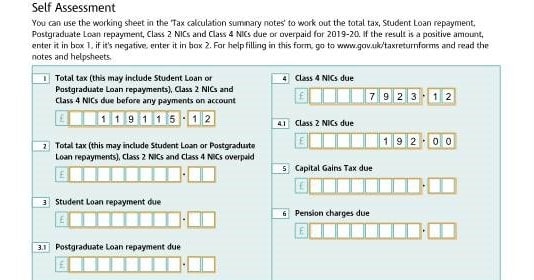

ShareFisherman NIC Class 2 calculation input figure different to Tax computation and SA110 (Personal Tax Return TC1 Box 4.1)

Resolution

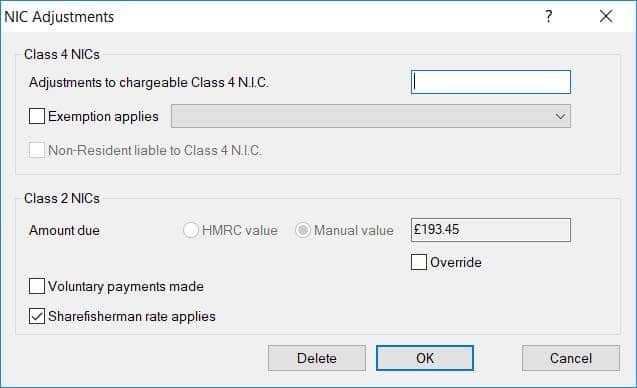

Currently when selecting the option ‘Sharefisherman rate applies’ within the NIC adjustment data screen the correct amount of NIC is calculated at £193.45 (£3.65 x 53wks), however running the computation the amount £192.00 is being displayed (this is also the case for the tax return). Unfortunately, there is no estimated date for this to be fixed or workaround, at this precise moment in time. However, there is a service pack due to be released on week commencing 18th May 2020, which may have the implemented changes.

The calculation shows correctly in the Data Entry Screen.

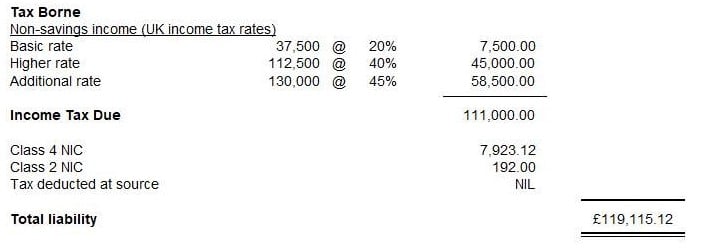

Please see the Personal Tax Computation and Personal Tax Return (TC1 Box 4.1) below.

Expected results/Solution: Amount of £193.45 should be reflected on the computation and return.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.