Trust Tax- You have reached your License Package Limit. Select client that has data entered for current tax year

Article ID

trust-tax-you-have-reached-your-license-package-limit-select-client-that-has-data-entered-for-current-year

Article Name

Trust Tax- You have reached your License Package Limit. Select client that has data entered for current tax year

Created Date

10th December 2024

Product

Problem

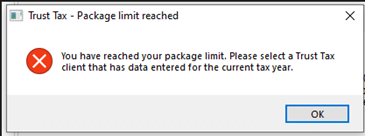

Trust Tax- You have reached your License Package Limit. Select client that has data entered for current tax year

Resolution

Trust Tax has TWO license checks running at the same time. You may have both issues, so you have too many active clients AND too many clients with data entered for a specific tax year. You will need to identify if one or both apply:

- How many active/registered clients you have running. For example you have 21 trusts and you have a limit of 20 then you are over your limit. There is a IRIS report you can run to list these clients. If you are below your license limit then you will have issue 2).

- How many clients have data entered for them in a specific year. This warning will normally show if you try and load any client in a specific year yet other years are unaffected. For example if you have a license for 20 Trusts. This means that you can have 20 Trust client entries in each tax year (For example in 2023 you can only have entered data for 20 clients but you may have entered data for 21+ clients which trigger’s the warning when you load the 2023 year, yet in 2022 and 2024 you don’t get the warning). The Trust license will get utilized any time a client has data entered in a tax year even if you have not submitted anything for that client and will even apply if the client is Archived/Unregistered. This check has to done manually per client.

a. If your number of active/registered clients exceeds your license limit, you will get the warning, so always first check how many active clients you have: At the very top of Trust tax- go to ‘Client’ and then ‘Select’.

b. Click ‘Generate client list‘ on the top right icon but if its not there look to the very bottom of the screen and see a PRINT option there). Tick the ‘Trust Tax’ option box. You will also need untick all the Business Type options on the bottom left as well

c. On the Selection tab, tick the TRUSTS tick box, then run the report. The last page of the report will show a count of how many active Trust clients you have: ‘REPORT TOTALS NUMBER OF CLIENTS = XXX’. (Do not use the ‘CURR’ column as that is linked to the PM license). Note 1: If you select ‘No restriction’ option- it lists clients which have already been unregistered/archived. Note 2: If you untick ‘Exclude unregistered clients’ option- this will allow you to list archived/unregistered clients with the active clients. Note 3: This ‘active/registered report’ is not designed to pick up each years data entry for clients, which is why it can look like you are below your package limit when really you have exceeded the limit. This has been raised for a future enhancement to reporting.

Warning to save you time: If you first unregister/archive clients to reduce the number of clients, then you may need to re-register them again to allow you to check each one for any entries in the clients tax year (thus taking up your time). So we recommend you first check every client before you archive/unregister them.

- If the ‘active/registered client number‘ is below your license number, then you have too many clients with data entered for the specific tax year. First load another tax year and load a client, and note down which years also get the same warning. Any tax entries made for a client on a year can use up a license even if you have not submitted anything for this one client. For example: you need to enter data for 2023 for 1 client but get the warning – yet you can still access 2022 and 2024 years and you are already below the number of active/registered clients.

- Manually look into every client (also look at unregistered/archived clients) for the affected year XXXX and you have to decide which client has their specific year data deleted and free up 1 license space (Load the client, select the year and go to Edit/Delete tax year but depending on your company data policies, eg: keep a copy of the data in case you need to recover it – eg Client/Export and keep copies of Schedules/Tax comp etc). If your company data policy states it cannot delete clients year data then you have to contact IRIS licensing to purchase more licenses.

- Existing Unregistered/Archived Clients: If you already have Unregistered/Archived Clients in your system when you got the license warning then you also need to check if those clients have data entered into the specific year. So re-register them and check and then unregister them.

- Keep a note of every client you have checked AND also the ones you deleted the tax year data for – Trust tax will not record these deletions so you need to to record which clients you checked.

- Once you have deleted a sufficient number of years data from X amount of clients. Close Trust Tax and restart it. Now load the affected tax year, if the warning still appears then continue to check and delete tax years from the clients you haven’t checked yet. Continue until you don’t get the warning.

- Recommendation: If you enter any data for a new Trust Client in a certain year (and don’t submit a tax return for them)- keep a count/note of these clients as they are now using up a license and this means checking your entire client list if the limit warning happens will be easier.

- Trust tax dosnt have a specific report to list clients in a specific year which has data entered into it. You have to manually check every client.

So you will need to manually look at each clients data for the affected YEAR (As from the above steps 1 to 7)

OR

Purchase more Trust licenses, please contact the IRIS Billings/License team.

If you cannot identify the clients which is triggering the package limit warning then raise a CASE under the IRIS Community system and state how many clients you have manually gone through, how many active clients are running (can be run from report above) and how many archived clients are in your database (can be run from report above).

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.